Neither Goless nor Greenlite offers a free trial.

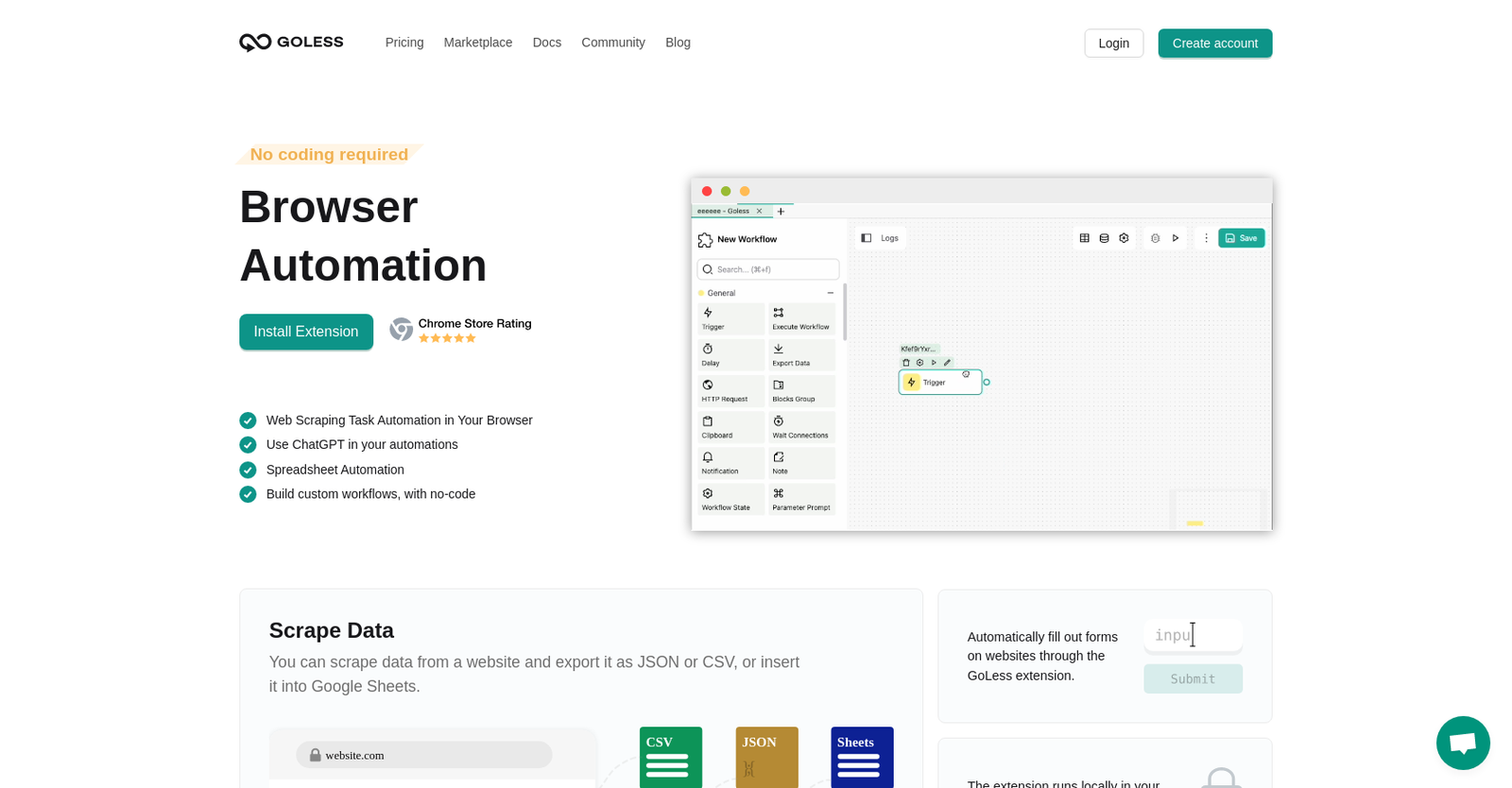

The starting price of Goless begins at $9.99/month, while pricing details for Greenlite are unavailable.

Greenlite offers several advantages, including Automated fintech compliance optimization, Aims for small team competitiveness, Focuses on AML, KYC tasks, Augments staff in needed areas and many more functionalities.

The cons of Greenlite may include a No live support, Limited to fintech industry, No multi-language support, Waitlist required for access. and Limited to AML and KYC tasks