AI stock market software is revolutionizing trading by enabling smarter, faster, and data-driven decisions. These tools leverage AI to analyze market trends, process real-time data, and execute trades with precision, helping traders optimize strategies and maximize opportunities.

AI trading bots offer 24/7 monitoring, refined analytics, and automated execution, reducing human error and enhancing efficiency. With their ability to adapt to market changes, these systems empower traders to stay competitive and achieve better outcomes.

This guide simplifies the process of choosing and setting up AI trading software. From exploring features to integrating tools into your workflow, unlock smarter trading solutions tailored to your goals.

Key Takeaways

- AI trading software helps traders analyze data quickly, reduce emotional mistakes, and trade 24/7. Examples include TrendSpider, Trade Ideas, Tickeron, and Algoriz.

- Start by choosing software that matches your goals (e.g., speed or ease of use). Use backtesting tools to test strategies with historical data before live trading.

- Ensure compatibility with platforms like MetaTrader or Robinhood using APIs for smooth integration and real-time updates during trades.

- Set clear risk limits (e.g., max 2% per trade) and define automated rules like stop-loss orders to protect profits and minimize losses.

- Regularly update the software for better performance, safety patches, and adapting to market changes using machine learning insights.

Choosing the Right AI Stock Market Software

Selecting the right AI stock market software can significantly enhance your trading approach. The key is to identify software that aligns with your trading style, integrates seamlessly with your tools, and meets your specific requirements.

Identify Your Trading Goals

Start by defining your trading objectives. What do you hope to achieve? Some traders prioritize speed and efficiency, focusing on features like high-frequency trading (HFT). Others look for intuitive, user-friendly platforms that simplify their workflow. Advanced tools such as machine learning for predictive analysis are also highly sought by traders aiming for a deeper edge in the market.

Security is another essential factor. Look for software with strong authentication methods and robust data protection measures to secure your information.

Additionally, understanding your risk tolerance is crucial. Set clear boundaries for acceptable losses and target gains. For example, day traders often lean toward software designed for rapid trades and quick profits, while long-term investors typically prefer tools with comprehensive analytics to support well-informed decisions.

As Antoine de Saint-Exupéry famously said, “A goal without a plan is just a wish.” Clearly outlining your trading goals and risk parameters lays the foundation for a successful AI trading strategy.

Compare Software Features

Once you’ve defined your objectives, evaluate the key features of different AI stock market software options. Each software has unique strengths, making it important to match their offerings with your needs. Here’s a quick comparison of popular choices:

| Software | Rating | Pricing | Key Features |

|---|---|---|---|

| TrendSpider | 4.5/5 | $22.11–$64.99/month | Automated trendlines, heatmaps, strategy testing tools |

| Trade Ideas | 5/5 | $118/month (Standard), $228/month (Premium) | Holly AI for entry/exit signals, advanced backtesting, customizable trading strategies |

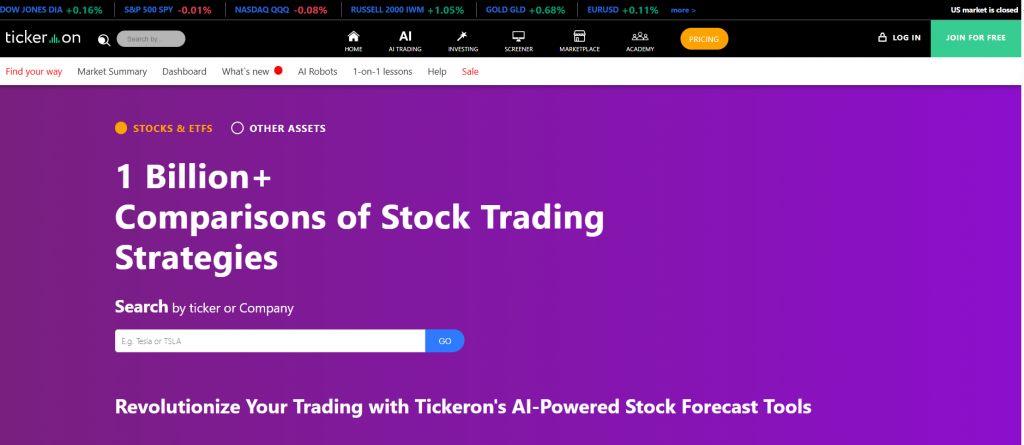

| Tickeron | 3.5/5 | Starts at $90/month | Neural network-powered trading, prediction accuracy analysis, interactive trading rooms |

| Algoriz | 4/5 | Free plan; $29–$69/month | Extensive strategy libraries, simple backtesting, user-friendly interface |

TrendSpider excels in providing tools for technical analysis, Trade Ideas offers advanced AI-driven signal generation, Tickeron uses neural networks for precise predictions, and Algoriz provides a vast library of customizable strategies.

Check Compatibility with Your Trading Platform

Compatibility with your existing trading platform is critical. Ensure the AI software supports platforms like MetaTrader, Interactive Brokers, or Robinhood. Many software options utilize APIs to enable seamless integration, allowing for real-time data synchronization and efficient trade execution.

Verify whether the integration process is straightforward and confirm whether there are any additional fees for syncing with your preferred trading platform. To further enhance your experience, consider features like custom notifications, mobile app availability, and user support.

By following these steps, you’ll be well on your way to selecting AI stock market software that complements your trading strategy, improves decision-making, and aligns with your goals.

Installing AI Stock Market Software

Setting up AI stock market software is straightforward. It involves meeting system requirements, downloading the program, and configuring it for optimal use. By following these steps, traders can ensure a seamless installation and setup, enabling the software to enhance their trading performance.

System Requirements and Setup

Before installing AI trading software, confirm that your computer meets the necessary system requirements. Most programs are designed to work efficiently with modern processors such as Intel i5 or higher and at least 8GB of RAM. For operating systems, Windows 10, macOS Catalina, and some Linux distributions are commonly supported. Adequate storage is also important, typically requiring at least 500MB of free space.

A reliable and fast internet connection is crucial for accessing real-time market data and ensuring uninterrupted operation during trading hours. Traders planning to use advanced AI tools should also check whether their platform supports programming languages like Python or JavaScript, which are often used for customization and strategy development.

Security is another key consideration. Ensure the software uses Secure Socket Layer (SSL) encryption for safe data transfers, and enable multi-factor authentication to add an extra layer of protection. Keeping antivirus programs updated on all connected devices helps maintain cybersecurity. Mobile users must verify compatibility with Android or iOS apps via platforms like Google Play to ensure smooth integration with online trading tools such as MetaTrader 4/5 or other algorithmic trading systems.

Downloading and Installing the Software

Visit the official website of your selected AI stock market software to download the program. Look for the version compatible with your operating system, whether it’s for Windows, macOS, or a mobile device. Select the appropriate option and click “Download.” Since file sizes vary, confirm you have sufficient storage space before proceeding.

Once the download is complete, open the installer file to begin the installation process. Follow the on-screen instructions, choosing either the default installation folder or specifying a preferred location for the program. The installation process is typically guided and user-friendly, requiring only a few clicks to complete.

After installation, launch the software and log in using the credentials provided during registration. Enable two-factor authentication for enhanced security and verify that all necessary plugins and tools are active. It’s also good to check for updates immediately after installation to ensure the program runs on the latest version.

Initial Configuration Steps

The final step is to configure the software according to your trading preferences. Customize the user interface for easy navigation and enable data security features to protect sensitive information. If applicable, ensure compliance with regulations such as the General Data Protection Regulation (GDPR).

Integrate the software with your preferred trading platform and set up secure databases to store trading history. Enter basic account details and test the system’s compatibility through small simulations or test trades. Configure risk parameters and set clear goals for your trading strategy to maximize the software’s potential.

By carefully following these steps, traders can effectively install and set up AI stock market software, paving the way for a more efficient and data-driven trading experience.

Configuring the Software for Your Trading Strategy

Setting up AI trading software to align with your trading strategy is essential for achieving consistent and effective results. This involves defining risk parameters, selecting suitable markets, and establishing clear, automated trading rules.

Inputting Your Risk Parameters

Begin by clearly defining your risk tolerance. Set specific limits, such as maximum daily losses or the percentage of account balance at risk per trade. For example, risking no more than 2% of your capital per trade helps manage market fluctuations and ensures disciplined decision-making.

Incorporate technical analysis tools like the Relative Strength Index (RSI) to identify optimal entry points. AI trading bots adapt strategies based on these inputs, maintaining alignment with evolving market conditions. Traders using programming languages like Python can fine-tune their systems to follow these parameters with precision.

Automated trading fosters consistency by eliminating emotional decisions, enabling a more systematic approach to the financial markets. Reviewing licensing guidelines from regulatory bodies such as the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA) ensures compliance and safeguards your investments during market shifts.

Selecting Trading Pairs or Markets

Choose markets that complement your trading style and objectives. For instance, stock trading often offers stability with slower price movements, while cryptocurrencies present opportunities for higher returns due to their dynamic price swings.

Liquidity is another critical factor. Opt for assets with strong liquidity, allowing for quick transactions without significantly impacting market prices. This ensures that your capital remains accessible for active trading. Markets with low liquidity may tie up funds, limiting flexibility.

Match your strategy to the market type. Fast-paced markets, such as cryptocurrencies, are well-suited for day trading, while long-term investments may benefit from the steadiness of established blue-chip stocks.

Setting Up Automated Trading Rules

Establish clear and actionable trading rules within the software. Define parameters for buying and selling, including price thresholds and market trends. Use stop-loss orders to cap potential losses and take profit levels to secure gains automatically.

AI-powered bots execute trades faster and more accurately than manual methods, promoting consistency. Advanced tools within the software allow traders to backtest these rules in simulated environments, ensuring effectiveness before live trading begins.

Enhance results by linking reliable data sources to support real-time decision-making. With these steps, traders can configure their AI trading software to align seamlessly with their goals, optimizing performance across diverse market conditions.

Integrating Data Sources

Integrating reliable data sources into AI stock market software is essential for informed and efficient trading. By combining real-time market feeds with historical data, traders can make smarter decisions and optimize their strategies.

Connecting Real-Time Market Data Feeds

AI trading software uses APIs to connect seamlessly to platforms like MetaTrader, Interactive Brokers, and Robinhood. These connections provide continuous live updates on stock prices, volumes, and trends, enabling traders to stay ahead of market movements.

Real-time data is especially important in fast-paced markets, such as cryptocurrencies, where prices can shift significantly in a matter of minutes. Instant access to accurate updates allows traders to respond quickly to opportunities and changes, ensuring precision in decision-making.

Efficient API functionality is critical for smooth integration with your trading platform. It ensures your system delivers actionable insights and executes trades promptly, helping to maintain a competitive edge.

Incorporating Historical Data for Backtesting

While real-time data supports quick decision-making, historical data adds valuable context by revealing patterns and trends. Analyzing years of price movements helps uncover recurring behaviors that machine learning (ML) algorithms can leverage to refine predictive accuracy.

Historical data plays a key role in backtesting, allowing traders to evaluate strategies against actual past performance. By simulating trades using historical data, traders can assess the effectiveness of their rules without financial risk.

Machine learning algorithms use these insights to enhance predictions and adapt to future changes, helping traders stay prepared for dynamic market conditions. Integrating both real-time and historical data creates a well-rounded foundation for informed, confident trading decisions.

Utilizing AI Features

AI trading tools are transforming the way traders approach financial markets. These tools enable smarter, faster, and more consistent trading decisions by analyzing trends, automating trades, and offering round-the-clock monitoring.

Machine Learning for Predictive Analysis

Machine learning leverages historical market data to identify patterns and predict future stock movements. For example, tools like TrendSpider use automated trendlines and heatmaps to provide actionable insights, helping traders fine-tune their strategies.

When paired with real-time data, machine learning becomes even more powerful. It adapts quickly to new information, ensuring predictions remain relevant and accurate. This capability helps traders navigate dynamic markets, such as cryptocurrency or traditional stocks, with greater confidence.

Platforms like eToro CopyTrader, which incorporate AI-powered strategies, have shown notable success. In certain cases, users report returns of over 50%, which highlights AI’s potential to enhance trading outcomes.

Automated Trading and Execution

AI bots excel at executing trades with speed and precision. By accessing real-time data through platforms like MetaTrader, Interactive Brokers, or Robinhood, these bots respond instantly to market changes. This speed is particularly valuable in fast-moving markets, where timely execution can secure better prices.

Automated bots operate based on predefined rules set by the user, ensuring consistency in every trade. They analyze patterns, predict market movements, and execute strategies without hesitation, making them reliable partners for cryptocurrency and stock trading.

24/7 Market Monitoring

AI trading software monitors global markets continuously, providing traders with an uninterrupted flow of updates. This constant surveillance ensures immediate responses to price shifts, market news, or liquidity changes.

This capability is invaluable for high-frequency traders and cryptocurrency enthusiasts. Unlike traditional stock markets with fixed hours, cryptocurrency markets run 24/7, making AI tools essential for tracking and reacting to opportunities around the clock.

Real-time notifications and swift execution help traders capitalize on gains and mitigate risks. By utilizing AI’s full range of features, traders can stay ahead in competitive markets and achieve their financial goals more easily.

Testing and Optimizing Your Setup

It’s essential to test and refine your AI trading software’s settings to ensure it aligns with your goals and performs optimally. By running simulations, backtesting strategies, and analyzing performance metrics, traders can continuously improve their outcomes while reducing potential risks.

Running Simulations and Backtesting

Simulations and backtesting are crucial for evaluating your trading strategy before live implementation. By using historical market data, AI tools like Trade Ideas can uncover patterns and refine predictions through advanced backtesting features.

Running these tests allows traders to identify weak points in their strategies, such as unoptimized entry or exit points. Using accurate historical data ensures the software aligns with market trends, enhancing predictive accuracy and minimizing surprises during live trading.

Through simulation, traders can fine-tune their settings based on test results. Adjustments made during this stage can reduce risks and optimize profitability, ensuring the software operates effectively when deployed in real markets.

For instance, Trade Ideas’ Holly AI provides entry and exit signals, helping traders test strategies under realistic market conditions.

Fine-Tuning Strategies Based on Results

Analyzing the performance of past trades through machine learning algorithms is an effective way to improve strategy outcomes. Historical data provides insights into patterns, enabling traders to identify areas where their strategies could be enhanced.

Conducting additional simulations with real-time market feeds helps evaluate how these modifications perform under current market conditions. This iterative process ensures that the strategy adapts to changing dynamics and remains effective over time.

Small adjustments often lead to significant improvements in efficiency and profitability. Whether optimizing entry points, tweaking risk parameters, or enhancing execution rules, each refinement contributes to more consistent trading performance.

For example, if performance metrics indicate excessive losses or inconsistent profits, traders can adjust their risk parameters, such as tightening stop-loss orders or refining profit targets. Automated trading rules, such as market entry and exit criteria, can also be tailored to improve results.

Monitoring Performance Metrics

Monitoring key performance metrics regularly is essential for identifying trends and making timely adjustments. Metrics such as profit margins, loss rates, and trade success percentages offer valuable insights into the strategy’s strengths and areas for improvement.

AI tools equipped with real-time analytics simplify this process by providing instant updates on how the strategy is performing. These insights enable traders to make data-driven decisions, ensuring the strategy remains aligned with their goals.

Keeping the software updated is equally important. Market conditions evolve rapidly, and outdated algorithms or data can impact results. Regular updates ensure the software remains compatible with the latest market trends and performs at its best.

Effective monitoring not only boosts return but also minimizes errors, ensuring that trading decisions are consistently informed by the most current and accurate data. By testing, refining, and monitoring your setup, you can create a robust trading system that adapts to changing markets and helps you achieve your financial goals with confidence.

Maintaining and Updating the Software

To get the most out of AI trading software, it’s essential to keep it updated, monitor its performance, and adjust settings to match market dynamics. A proactive approach ensures your trading system stays efficient, secure, and adaptable to changing conditions.

Regular Updates and Patches

Regular updates are vital for keeping your AI trading software running efficiently. Developers frequently release updates to address bugs, introduce new features, and ensure compatibility with evolving trading platforms, mobile apps, and web-based tools. By staying current, traders can access the latest improvements that enhance usability and functionality.

Security is another critical reason to prioritize updates. Cyber threats evolve alongside technology, and patches help close security gaps to protect sensitive data and trades. Ensuring your software has the latest security measures reduces vulnerabilities and safeguards investments.

Updates often optimize how the software processes data and adapts to market changes to maintain algorithm effectiveness. Staying informed about new patches and implementing them promptly ensures the system operates at its peak.

Monitoring AI Algorithm Effectiveness

Consistently tracking the AI’s performance is crucial for long-term success. Key metrics such as prediction accuracy, execution speed, and profit margins offer insights into how well the software aligns with trading goals. Tools for usability testing can also identify weaknesses in predictions or automated decisions.

Monitoring ensures the software remains effective as market conditions evolve. Algorithms may need adjustments to keep up with these changes. Investment managers often rely on machine learning systems that excel in volatile markets, such as cryptocurrency, where rapid adjustments are necessary.

For example, backtesting strategies with historical data help predict new outcomes and refine the AI’s adaptability to shifting trends.

Regular monitoring and fine-tuning can help traders stay ahead, reducing potential risks and maximizing opportunities as conditions change.

Adjusting to Changing Market Conditions

Market conditions are inherently dynamic. Economic reports, political events, or unexpected global crises can disrupt established trends, making it essential to adjust strategies quickly. While AI tools rely on historical data, these events may challenge their predictive capabilities.

To manage these changes effectively, traders should regularly review and update risk parameters. This involves setting tighter stop-loss orders during periods of instability or revising profit targets as new trends emerge. Machine learning-powered AI tools are particularly adept at adapting over time by analyzing fresh patterns and adjusting strategies to align with evolving market behaviors.

Pairing AI predictions with human oversight further enhances decision-making during volatile situations. Traders who stay actively involved can better navigate unpredictable markets and optimize their outcomes.

Tips for Maximizing Your AI Trading Experience

AI trading tools are powerful assets, but using them strategically ensures a more balanced and successful trading experience. Flexibility, diversification, and staying informed are key to achieving long-term results.

Diversifying Trading Strategies

Diversification is a proven method for reducing risk and enhancing returns. By mixing strategies like day trading, swing trading, and long-term investing, traders can spread exposure and benefit from varied market opportunities. AI tools are versatile enough to support different methods, helping traders adapt to changes effectively.

Machine learning algorithms are particularly valuable here. They analyze historical data to identify patterns and predict trends for various strategy types. This allows traders to make informed decisions, whether focusing on short-term trades or holding positions for extended periods.

Expanding into multiple markets, such as stocks, cryptocurrencies, and commodities, can also reduce risk. Trading across diverse asset classes minimizes the impact of downturns in any single market sector. While automated trading is highly effective, incorporating manual input when needed adds flexibility and allows for nuanced decision-making.

Avoiding Over-Reliance on AI Predictions

While AI tools are excellent for identifying trends and optimizing strategies, they are not infallible. Predictions rely heavily on historical data and may not fully account for sudden market shifts or unexpected events like economic crashes or rapid booms.

To mitigate these limitations, traders should use AI tools as guides rather than guarantees. Human oversight remains essential for managing risks and ensuring well-rounded decisions. Staying actively involved in monitoring trades, analyzing market conditions, and consulting financial experts can provide valuable insights that complement AI-driven strategies.

Combining automated trading with personal analysis creates a balanced approach that leverages the strengths of both methods. This enhances decision-making and adds a layer of adaptability to the trading process.

Staying Updated with Market Trends

Keeping up with market trends is critical for making timely and informed trading decisions. AI tools simplify this process by integrating real-time data feeds and analyzing market movements continuously. Platforms like eToro CopyTrader, for instance, showcase successful trades from top investors, providing inspiration and guidance for refining strategies. Some traders using these strategies have reported impressive returns, with gains of over 50% in just a couple of years.

AI trading bots equipped with live updates and news scanning capabilities help traders stay informed about sudden market changes or shifts in buyer behavior. These real-time insights allow for quick adjustments, ensuring strategies remain relevant and effective.

Machine learning further enhances this process by predicting changes before they occur, using patterns from both historical and real-time data. This proactive approach improves decision-making, helping traders capitalize on opportunities and minimize potential risks.

Conclusion

AI trading software revolutionizes financial markets by enhancing efficiency, accuracy, and decision-making. Leveraging machine learning and real-time analytics, these tools identify opportunities, execute trades swiftly, and rapidly adapt to market changes.

To maximize potential, traders should maintain regular updates, monitor performance, and align strategies with evolving goals. Combining AI’s automated precision with human oversight ensures adaptability and long-term success.

Traders can achieve consistent results by integrating data-driven insights, diversifying strategies, and staying market-savvy. AI tools are a powerful ally, empowering traders to navigate complexity, seize opportunities, and thrive in competitive markets.

Frequently Asked Questions about AI Stock Market Software

What is AI stock market software, and how does it work?

AI stock market software uses artificial intelligence and machine learning to analyze data, predict trends, and automate trading decisions. It can help traders optimize strategies for cryptocurrency trading or traditional markets.

How do I set up automated trading with AI tools?

Start by choosing a platform that fits your needs. Focus on user experience (UX) and interface design for easy navigation. Test the app during prototyping to ensure smooth functionality before relying on it for live trades.

Can AI improve my trading strategy without a steep learning curve?

Many platforms offer recommendations based on social media trends, buyer behavior, or copy trading features, simplifying decision-making while reducing the fatigue of manual analysis.

Is cybersecurity important when trading with AI?

Protecting sensitive data, such as financial details, is crucial in app development. Look for robust cyber security measures to safeguard against breaches while effectively leveraging technology.

Do I need technical expertise to use AI-driven tools in my LLC’s strategy?

Modern apps are designed with UI/UX principles to minimize complexity so you can brainstorm ideas quickly and start using them—even if you’re new to this boom in AI-powered solutions!