The payments industry is undergoing a major transformation, and Payman AI is leading the way with AI-powered solutions that enhance speed, security, and efficiency. Traditional payment systems often face challenges like slow processing times, fraud risks, and high costs, but Payman AI streamlines transactions with automation and real-time analytics.

By integrating AI-driven fraud detection and predictive financial insights, businesses can optimize financial operations and reduce errors. With its intelligent payment processing and seamless automation, Payman AI is revolutionizing how businesses and consumers handle transactions. As artificial intelligence continues to shape the fintech landscape, Payman AI is redefining digital payments in 2025, making transactions faster, more secure, and highly efficient for businesses and individuals alike.

Key Takeaways

- Payman is a payment system that enables fast, real-time transactions to send and receive money with ease.

- Payman uses AI technology to boost security, prevent fraud, and speed up transactions.

- Many benefits are available to users, such as fast setup for businesses, mobile payments, and easy management of subscriptions.

- Some real-world applications of Payman include shopping online, paying freelancers fast, and handling subscription services without hassle.

- The growing trend of using digital wallets indicates how much fast, secure payment options like Payman are needed globally.

Understanding Payman AI: A Revolutionary Payment Solution

Payman transforms how people manage money, making payments faster and easier for everyone.

A payment system enables people to send and receive money for financial transactions, transferring monetary value from one person to another. There are two main types: Non-real-time payment systems (NRTPs) and Real-time payment systems (RTPSs).

NRTPs take time to clear funds, meaning the money isn’t available right away. RTPSs, on the other hand, move money instantly. Examples like M-PESA and Venmo show how RTPSs work fast.

The number of countries that implemented real-time payments rose from 17 in 2014 to over 56 by 2022. It means more people want their money to move fast. Closed systems like Venmo serve specific purposes, while open ones like M-PESA allow users to spend more money on different services.

Payment systems are the key to moving monetary value securely and efficiently.

Key Features and Capabilities

Here is a summary of Payman AI‘s key features and capabilities:

| Feature | Description |

|---|---|

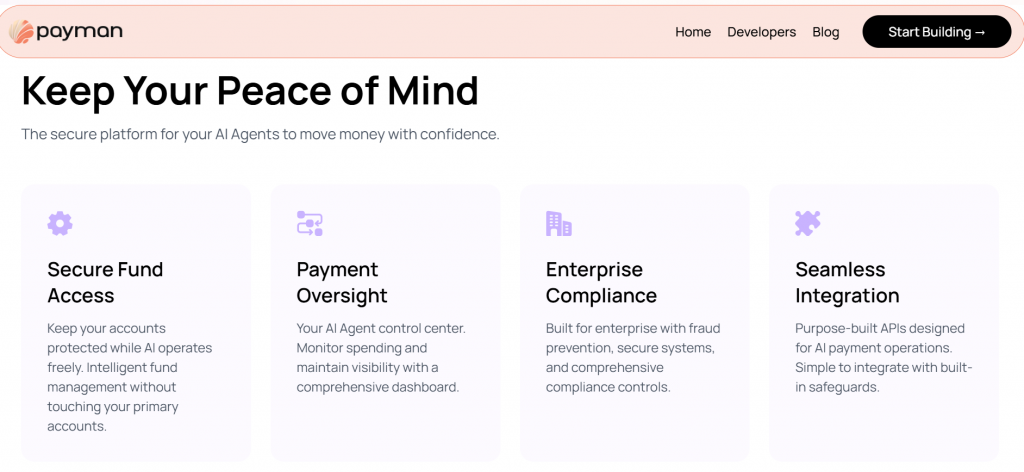

| AI-First Design | Payman provides financial infrastructure tailored for AI agents, enabling them to move money securely and efficiently without accessing primary accounts. |

| Built-in Compliance | Enterprise-grade compliance features, including transaction monitoring and fraud prevention, are integrated into every payment to maintain security and trustworthiness. |

| Secure Fund Orchestration | Payman manages dedicated AI accounts with predictive funding, ensuring AI agents have the necessary capital without direct access to primary funding sources, thereby protecting main accounts. |

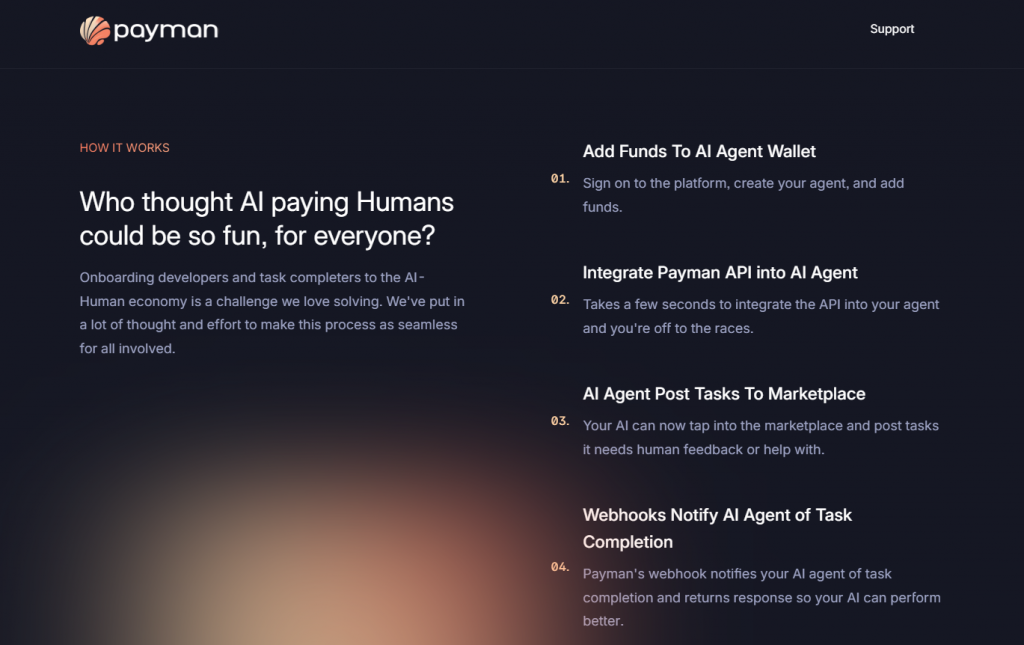

| Seamless Integration | The platform offers purpose-built APIs designed for AI payment operations, facilitating simple and secure integration into existing systems. |

| Multi-Currency Support | The platform supports various payment methods, including fiat currencies and cryptocurrencies, allowing AI agents to engage with individuals globally and cater to diverse payment preferences. |

| Task Management System | Payman includes built-in tracking and management tools for AI-assigned tasks, ensuring efficient monitoring and control over operations. |

| Spending Controls | The platform provides sophisticated budgeting and limit management for AI agents, allowing for the customization of spending limits and alerts to monitor expenditures effectively. |

| Webhook Notifications | Automated task completion notifications and response handling are facilitated through webhook notifications, ensuring timely updates and efficient communication between AI agents and human collaborators. |

These features collectively enhance Payman AI’s utility in facilitating secure and efficient financial interactions between AI agents and human collaborators.

How Payman AI Payments is Revolutionizing

Payman AI changes the way we conduct payments. It uses smart tech to make transactions faster and safer for everyone.

AI is revolutionizing how we conduct financial transactions. This provides added security using biometric authentication and voice-initiated payments. It makes fraudulent activity more intelligent, preventing losses to a certain extent.

AI algorithms enable credit card companies to alter limits and customize benefits according to individual spending preferences.

Digital wallets use AI agents for safer transaction processing and fraud prevention. This change will see the payment industry grow more in the coming years. I find that embedding AI in payments helps organizations stay competitive and improves their operational efficiency in many areas.

Benefits for Users and Businesses

Payman AI makes it easy and fast for both users and businesses to pay.

Business Application Integration

Payman AI seamlessly integrates with ERP, CRM, and accounting systems, streamlining financial workflows for businesses. It automates payment tracking, reconciliation, and reporting, reducing manual errors and saving time. Real-time updates ensure all departments are informed of payment statuses, boosting operational efficiency. By connecting with platforms like QuickBooks, SAP, and NetSuite, Payman AI provides a centralized and error-free payment management experience.

Customer Payment Facilitation

Payman AI simplifies the process of making payments to customers, partners, and vendors. With features like one-click transfers and automated disbursements, businesses can reduce manual intervention and delays.

The platform enhances transparency through detailed payment records and real-time notifications, fostering stronger relationships with stakeholders. It supports various payment needs, including refunds, loyalty rewards, affiliate commissions, and freelance payments, ensuring efficiency and reliability.

Subscription Service Management

Managing recurring payments becomes effortless with Payman AI, making it ideal for SaaS, memberships, and subscription-based services. The platform automates billing cycles and supports multiple payment methods, such as credit cards, e-wallets, and direct transfers. Failed payments are reattempted automatically, and dunning management ensures customers are notified promptly, reducing churn and maintaining revenue consistency.

Online Payment Acceptance

Payman AI enables businesses to accept payments on e-commerce platforms and online stores with ease. It supports a variety of payment methods, including cards, digital wallets, and bank transfers, while also facilitating cross-border payments with multi-currency support.

This flexibility expands customer reach and enhances satisfaction. Secure payment processing, backed by end-to-end encryption and PCI compliance, ensures a safe and reliable transaction experience.

Pros and Cons of Payman AI

Payman AI is an innovative platform that enables AI agents to compensate humans for tasks requiring human intelligence. Below is a table summarizing its key advantages and potential drawbacks:

| Pros | Cons |

|---|---|

| Innovative AI-to-Human Payment System: Facilitates seamless compensation from AI to humans, enhancing task automation. | Initial Learning Curve: New users may need time to familiarize themselves with the platform’s features. |

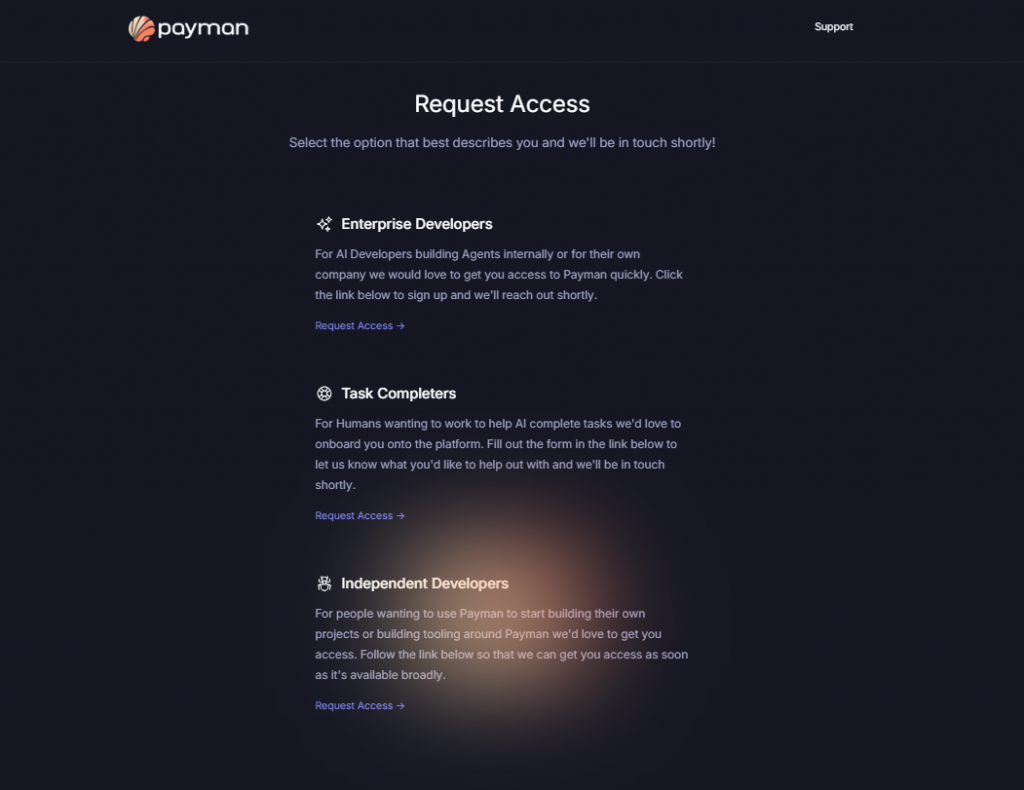

| Flexible Payment Options: Supports multiple currencies and payment methods, including fiat and cryptocurrencies. | Limited Beta Access: Currently available only to a limited number of users in the beta phase. |

| User-Friendly Integration: Offers easy-to-use APIs for quick integration into existing systems. | Dependence on AI Agent Adoption: The platform’s success relies on widespread adoption of AI agents requiring human task assistance. |

| Comprehensive Task Management: Provides sophisticated tracking and budgeting tools to monitor AI spending and task completion. | Security and Compliance Considerations: Handling payments between AI and humans necessitates robust security and compliance measures. |

These insights are based on available information and may evolve as Payman AI continues to develop and expand its services.

Real-World Applications of Payman AI

Payman AI facilitates real-life applications where transactions are smooth and prompt. It handles purchases, and online and freelancer payments and fulfills many other requirements in one go.

Online E-commerce Payments

E-commerce thrives on smooth payment processing. I’ve seen how failed payments can hurt trust and lower customer retention. That’s why I prioritize managing payments effectively to build loyalty.

Customizing payment options and optimizing the user experience makes it easier for customers to complete purchases. By focusing on the Payment Success Rate (PSR), I can ensure more successful transactions, boosting both customer satisfaction and business growth.

Freelance Payments

Freelancers require instant and guaranteed payments. I always understand that getting a deposit before the task makes a lot of sense, especially with new clients. Invoices must be released at least once per week for steady cash flow.

For immediate cash flow, options like invoice factoring work well. It’s crucial to have strong legal contracts that include terms for ownership rights and interest charges on overdue invoices.

Subscription Services

Subscription services make it easy to manage recurring payments and renewals, giving customers seamless access to their favorite products or content. I’ve seen how businesses use prebuilt checkouts and app integrations to simplify billing and improve the customer experience.

Personally, I find these tools helpful for managing subscriptions efficiently, ensuring payments are processed on time, and users stay connected without interruptions. It’s a smart way to build better customer relationships.

Conclusion

Payman AI has been a game-changer for me when it comes to managing payments. It simplifies transactions, whether for online purchases, freelancer payouts, or daily expenses. What stands out most is its speed, ease of use, and ability to handle multiple payment needs in one place.

With Payman AI, I no longer worry about missed payments or slow processing. It offers a smooth, secure, and efficient way to stay on top of my finances. For businesses and individuals alike, it’s a smart, reliable solution for handling payments with less hassle and more confidence in every transaction.

Frequently Asked Questions

What is Payman AI?

Payman AI is a tool that simplifies payments. It helps users manage transactions easily and efficiently.

How does Payman AI work?

Payman AI connects different payment methods, making it easy to send and receive money. Users can track their payments in one place.

Why should I use Payman AI?

Using Payman AI saves time and reduces confusion with payments. It offers clear tracking and quick access and supports various payment options.

Is Payman AI safe to use?

Yes, Payman AI prioritizes security for all transactions. It uses strong measures to protect user information during every step of the payment process.