AI stock market software offers a powerful solution by leveraging artificial intelligence to simplify trading and enhance decision-making. Stock trading involves analyzing vast amounts of data and responding to dynamic market conditions. Navigating this landscape and making confident decisions can be challenging for beginners.

These tools analyze extensive market data, identify patterns, and provide real-time actionable insights. From spotting trends to suggesting optimal trades, AI-powered platforms empower traders with data-driven strategies. The result is a more informed trading experience, where decisions are guided by advanced analytics rather than guesswork.

AI trading software benefits traders by reducing the time spent on manual analysis and improving prediction accuracy. With features such as algorithmic trading, portfolio optimization, and risk management, these tools cater to traders at every level, offering a seamless way to participate in the stock market.

This guide explores AI trading tools’ core features, advantages, and key considerations for selecting the best solution. Whether looking to refine strategies or streamline the trading process, AI tools provide an edge in today’s competitive markets.

Key Takeaways

- Provides advanced AI-driven features like stock screening, pattern recognition, and trading signals.

- Offers free to $250/month plans to cater to different user needs.

- Includes tools for creating, managing, and optimizing investment portfolios.

- Offers webinars, tutorials, and community discussions to support trading education.

- Accessible to beginners and advanced traders alike.

- Premium plans can be expensive for budget-conscious users.

- Best suited for active traders and financial advisors looking for AI-powered insights.

- Some features may be overwhelming or complex for novice traders.

What is AI Stock Market Software?

AI stock market software harnesses the power of artificial intelligence to simplify trading and improve decision-making. These tools use advanced technologies such as machine learning, natural language processing, and deep learning to analyze vast amounts of financial data with remarkable speed and accuracy.

These systems identify market trends, forecast price movements, and can even execute trades automatically. By processing large datasets in real-time, they uncover patterns and assess external factors like news and social media sentiment that influence markets.

Traders frequently use AI tools for technical analysis, risk assessment, and portfolio management, reducing manual effort while enhancing precision. With its ability to streamline complex processes, AI stock market software is an essential asset for both novice and experienced traders.

Key Features of AI Stock Market Software

AI stock market software has tools to simplify and speed up trading. It uses smart technology to study data, predict market trends, and help users make better choices.

Automated Trading Tools

Automated trading tools execute trades without human input. These systems use machine learning algorithms and market data to identify the best opportunities. They operate 24/7, making trades quickly and efficiently, even when traders are offline.

Stock markets never pause; these tools ensure no missed chances.

They eliminate emotional decisions during stock trading. Tools follow specific strategies strictly, reducing common errors caused by fear or greed. For beginners, this means more accurate responses to market trends and less stress in decision-making processes.

Real-Time Market Analysis

AI tools track stock prices and news 24/7. They scan global markets 24/7, spotting trends as they happen. This helps traders react quickly to shifts that could affect their investments.

“Real-time analysis offers a significant edge in dynamic trading environments.”

Instant updates allow users to easily monitor forex, futures, and options trading. These systems also incorporate data from social media sentiment and technical indicators like Heikin Ashi charts for better predictions.

Predictive Analytics

Predictive analytics uses AI technology to forecast stock movements. It studies large data sets, like social media sentiment and market trends, identifying patterns that humans may miss.

These predictions often outperform traditional analysis.

AI bots analyze past data from financial securities and mutual funds quickly and precisely. They calculate potential risks in trading strategies while spotting anomalies during crises or market crashes.

This approach helps day traders make smarter decisions quickly without relying on emotions.

Customizable Alerts

Users can configure alerts for particular trading strategies. These cover risk levels, asset types, and technical indicators. Alerts generate immediate notifications when market conditions align with pre-established rules.

Push notifications keep traders informed without delay. For instance, users may get alerts for stock price fluctuations or emerging high-frequency trading opportunities. This feature operates seamlessly on both mobile apps and desktop platforms, ensuring every opportunity is captured during active markets.

Benefits of Using AI Stock Market Software for Beginners

AI tools make trading less stressful. They use data to help beginners make smarter choices faster.

Simplifies Trading Decisions

AI stock market software simplifies trading by eliminating uncertainty. It relies on data analysis and predictive models to recommend definitive actions. These tools clarify decisions by offering insights grounded in data.

Rational decisions take the place of emotional errors with AI tools.

For instance, automated trading systems quickly modify strategies in unstable markets. Instant notifications keep traders updated on price shifts or emerging trends, enabling prompt decisions without hesitation or postponement.

Reduces Emotional Trading

Automated trading tools execute trades without human emotions. They remove impulsive decisions caused by fear or greed. AI bots follow set strategies consistently, ensuring rational actions in every trade.

This approach prevents emotional mistakes, especially during market swings. Data-driven insights protect beginners from overreacting to losses or chasing trends. Algorithmic trading creates discipline, keeping trades logical and stable.

Provides Data-Driven Insights

AI stock market software processes extensive datasets within moments. Using machine learning, it detects trends, patterns, and inefficiencies. It monitors price changes, social media sentiment, and technical analysis indicators to propose trading strategies.

These tools adjust to new data for improved outcomes over time. They utilize predictive analytics to forecast future stock movements with notable precision. This aids traders in making well-informed decisions swiftly without depending solely on speculation or emotions.

Saves Time and Effort

AI bots execute trades in milliseconds. This speed is much faster than human traders can achieve. The continuous operation ensures 24/7 market monitoring without fatigue or breaks.

Customizable alerts instantly notify users of important changes. Real-time data representation reduces the need for manual tracking. Automated trading tools handle tasks like stock screening, leaving more time for strategy planning.

Automation eliminates repetitive tasks and boosts efficiency.

Apps like TradingView or TrendSpider allow technical analysis with minimal effort. These platforms simplify processes using AI-driven predictive analytics and easy-to-use features.

Small traders benefit from quicker decisions and better results.

Top AI Stock Market Software for Beginners

Explore beginner-friendly AI tools designed to simplify stock trading and enhance decision-making—discover which fits your needs.

TradingView

TradingView is a comprehensive charting platform offering various features tailored to traders and investors. The platform supports cloud services for securely saving data across devices. Users can set customizable alerts via push notifications on mobile apps. It is perfect for both beginners and pros seeking a reliable trading platform.

Below is an overview of its main features, pricing plans, and a summary of pros and cons.

TradingView Features

| Feature | Description |

|---|---|

| Advanced Charting Tools | Over 400 built-in indicators and 110+ drawing tools for technical analysis. |

| Multiple Chart Layouts | View up to 8 charts per tab, depending on the subscription plan. |

| Custom Time Intervals | Analyze data with custom timeframes, including second-based intervals in higher-tier plans. |

| Alerts System | Set up to 400 customizable price and technical alerts for real-time updates. |

| Social Community | Engage with a community of traders to share ideas and strategies. |

| Backtesting | Test trading strategies against historical data for performance evaluation. |

| Real-Time Data | Access real-time market data from global exchanges, with some requiring additional fees. |

TradingView Pricing Plans

| Plan | Monthly Cost (USD) | Annual Cost (USD) | Charts per Tab | Indicators per Chart | Price Alerts | Technical Alerts |

|---|---|---|---|---|---|---|

| Free | $0 | $0 | 1 | 3 | 5 | 1 |

| Essential | $14.95 | $155.40 | 2 | 5 | 20 | 20 |

| Plus | $29.95 | $299.40 | 4 | 10 | 100 | 100 |

| Premium | $59.95 | $599.40 | 8 | 25 | 400 | 400 |

TradingView Pros and Cons

| Pros | Cons |

|---|---|

| Comprehensive analysis tools with over 400 indicators and advanced charting features. | Advanced features are locked behind paid subscription plans. |

| A User-friendly interface is suitable for beginners and experienced traders alike. | Real-time data for some exchanges requires additional fees. |

| Engaged community for sharing strategies and ideas. | Limited integration with certain brokers for direct trading. |

| Cross-platform accessibility on the web, desktop, and mobile devices. | Ad-supported experience in the free plan. |

TrendSpider

TrendSpider simplifies technical analysis with smart tools. Its AI scans charts for trends, breakouts, and patterns in seconds.

Below is an overview of its main features, pricing plans, and a summary of pros and cons.

TrendSpider Features

| Feature | Description |

|---|---|

| Automated Technical Analysis | Automatically identifies trend lines, support/resistance levels, and patterns to save time and improve accuracy. |

| Smart Charts | Interactive and dynamic charts with automated updates and multi-timeframe analysis. |

| Backtesting | Allows users to test strategies against historical data to evaluate their effectiveness. |

| Alerts | Customizable alerts for specific price levels, patterns, or other criteria. |

| Market Scanning | Enables real-time scanning for trading opportunities based on predefined criteria. |

TrendSpider Pricing Plan

| Plan | Price | Features |

|---|---|---|

| Essential | $33/month (billed annually) | Basic technical analysis, automated trendlines, alerts, and multi-timeframe analysis. |

| Elite | $52/month (billed annually) | All Essential features + backtesting, additional alerts, and improved scanning capabilities. |

| Elite Plus | $79/month (billed annually) | All Elite features + extended alerts, advanced backtesting, and priority support. |

TrendSpider Pros and Cons

| Pros | Cons |

|---|---|

| Highly automated and time-saving features. | Steeper learning curve for beginners. |

| Comprehensive charting and market analysis tools. | Higher price compared to some competitors. |

| Customizable alerts and scanning. | Lacks integration with some brokers. |

| Effective for backtesting trading strategies. | No mobile app available. |

Trade Ideas

TrendSpider excels in technical analysis, but Trade Ideas stands out for AI-powered advanced scanning.

Trade Ideas also instantly integrates push notifications to inform users about key market movements. Security options include two-factor authentication (2FA) to protect accounts from breaches during transactions or portfolio management activities online.

Trade Ideas Features

| Feature | Description |

|---|---|

| Real-Time Stock Scanning | Provides real-time data for over 8,000 U.S. stocks, allowing traders to monitor market movements instantly. |

| Artificial Intelligence (AI) Assistance | Utilizes AI algorithms, such as ‘Holly’, to generate trade signals and identify patterns, enhancing decision-making. |

| Backtesting | Enables users to test trading strategies against historical data to evaluate their effectiveness. |

| Automated Trading | It integrates with brokers to execute trades directly from the platform and supports automated strategies. |

| Customizable Alerts | Allows setting personalized alerts based on specific criteria to notify users of potential trading opportunities. |

| Educational Resources | Provides tutorials, webinars, and a live trading room to support traders in enhancing their skills. |

TradeIdeas Pricing Plan

| Plan | Price | Features |

|---|---|---|

| Standard | $118/month or $999/year | Includes real-time data, charts, alerts, custom formulas, top lists, and a channel bar. :contentReference[oaicite:6]{index=6} |

| Premium | $228/month or $1,999/year | All Standard features plus advanced windows (RBI/GBI), backtesting, unlimited shareable price alerts, and Artificial Intelligence. :contentReference[oaicite:7]{index=7} |

Trade Ideas Pros & Cons

| Pros | Cons |

|---|---|

| Advanced AI-powered scanning and real-time data. | Higher cost compared to some other platforms. |

| Comprehensive educational resources and support. | The steeper learning curve for beginners. |

| Customizable alerts and automated trading capabilities. | Limited to U.S. stocks and ETFs; no international markets. |

| Robust backtesting tools for strategy evaluation. | No mobile app available. |

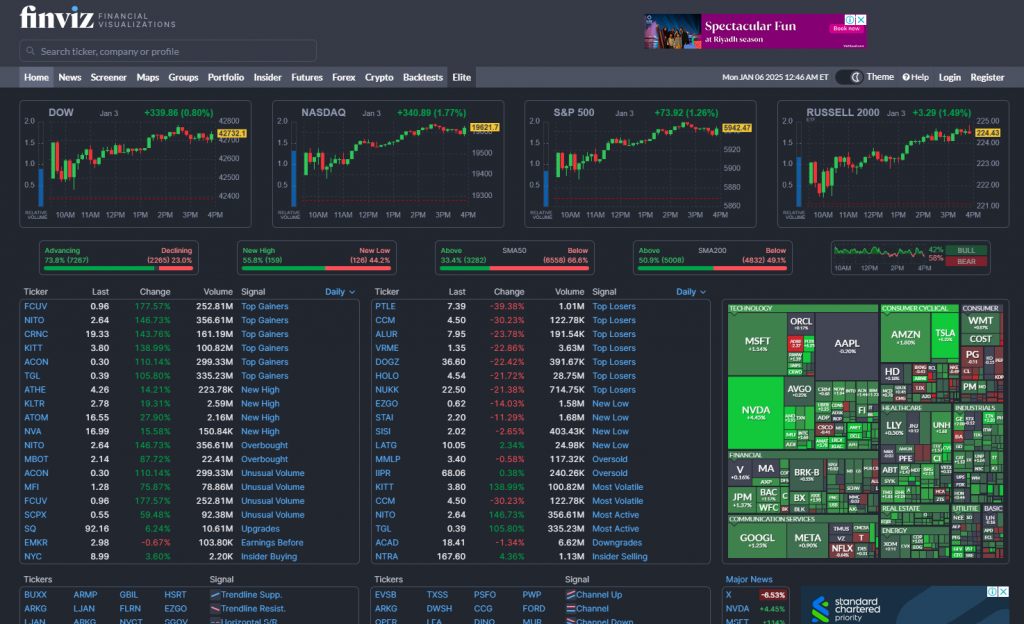

Finviz

Finviz offers free stock trading tools. The platform simplifies technical analysis with user-friendly filters and data visualizations. It is ideal for tracking market inefficiencies or creating trading strategies without added costs.

Below is an overview of its main features, pricing plans, and a summary of pros and cons.

Finviz Features

| Feature | Description |

|---|---|

| Stock Screener | Offers a comprehensive screener with over 67 fundamental and technical filters, allowing users to filter stocks based on various criteria. |

| Heat Maps | Provides visual representations of market data, showing the performance of various sectors and industries at a glance. |

| Charting Tools | Includes advanced charting capabilities with multiple chart types and technical indicators for in-depth analysis. |

| Backtesting | Allows users to test trading strategies against historical data to evaluate their effectiveness. |

| News Aggregation | Aggregates financial news from reputable sources, keeping users informed about market developments. |

| Insider Trading Data | Provides information on insider buying and selling activities, offering insights into company management’s actions. |

| Portfolio Tracking | Enables users to create and monitor multiple portfolios, tracking performance and managing investments effectively. |

Finviz Pricing Plan

| Plan | Price | Features |

|---|---|---|

| Free | $0 | Basic stock screener, delayed data, limited charting capabilities, and advertisements. |

| Registered | $0 (requires registration) | All Free features plus the ability to save screener presets and portfolios with delayed data and advertisements. |

| Elite | $39.50/month or $299.50/year | Real-time and pre-market data, advanced charting, backtesting, custom alerts, ad-free experience, and data export capabilities. |

Finviz Pros & Cons

| Pros | Cons |

|---|---|

| Comprehensive stock screening tools with numerous filters. | The free version has delayed data and includes advertisements. |

| User-friendly interface with visual market data representations. | No mobile app for on-the-go access. |

| Advanced charting and backtesting are available in the Elite plan. | The interface may feel outdated compared to competitors. |

| Aggregates news from reputable sources for informed. | Limited customization in screening parameters. |

| Offers both free and affordable premium options. | Limited to U.S. stocks and ETFs; no international markets. |

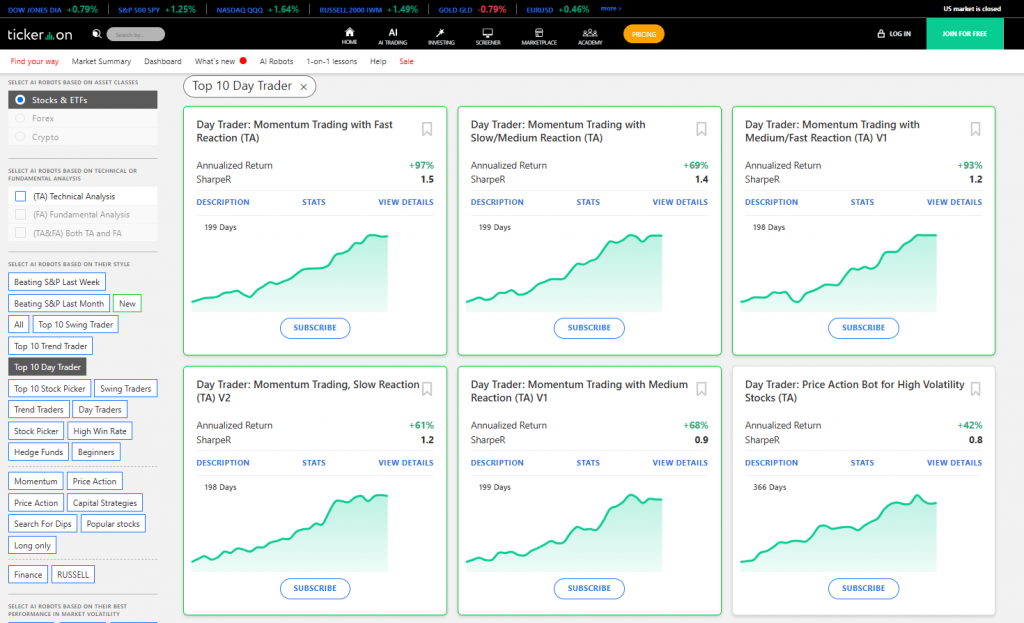

Tickeron

Tickeron offers AI-powered tools for stock trading and portfolio management. Its models use pattern recognition and social media sentiment to predict market trends.

Real-time alerts and predictive analytics help beginners avoid emotional trading decisions. The platform simplifies complex analysis through automated systems, saving effort and time.

Tickeron Features

| Feature | Description |

|---|---|

| AI-Powered Stock Screener | Utilizes artificial intelligence to scan and identify potential trading opportunities based on customizable criteria. |

| AI Robots | Provides real-time signals and recommendations based on extensive statistical analysis, assisting traders in decision-making. |

| Portfolio Wizard Organizer | Assists in creating and managing diversified portfolios tailored to individual investment goals and risk tolerance. |

| Backtesting Trade Rules | Allows users to test trading |

Tickeron Pricing Plan

| Plan | Price | Features |

|---|---|---|

| Beginner | Free | Access to basic functions such as portfolio diversity score and tools to help create a portfolio. |

| Intermediate | $15/month | Includes Active Portfolios/Autopilot, AI Trading Ideas, Backtesting Trade Rules, and Duplicate Portfolios. |

| Expert | $250/month | Access to all advanced features, including AI Robots, AI Pattern Search Engine, AI Prediction Engine, and AI Screener. |

| Advisory | $50/month | It is designed for certified financial advisors to offer their services through the platform. |

Tickeron Pros & Cons

| Pros | Cons |

|---|---|

| Offers a free plan with access to basic features. | Advanced features require paid subscriptions, which may be costly for some users. |

| Utilizes powerful AI algorithms for market analysis and trading signals. | Potential information overload for novice investors due to the wealth of data provided. |

| Provides comprehensive educational resources to enhance trading knowledge. | Relies on internet connectivity for real-time data, which could be a drawback for users with unstable connections. |

| Features a user-friendly interface suitable for traders of all experience levels. | Some advanced features may have a learning curve for beginners. |

How to Choose the Right AI Stock Market Software

Choose software that meets your needs, fits your budget, and is easy to use. Learn more about making a smart choice.

Identify Your Trading Goals

Decide if you want day trading, swing trading, or long-term investing. Each requires different tools and strategies. Day traders need fast analysis and real-time market updates, while long-term investors focus on portfolio management tools and fundamental analysis.

Choose software that supports your preferred assets like stocks, options, or crypto. Some platforms cater to specific markets or asset types better than others. Know what you’ll trade before committing.

Understanding goals helps avoid wasting money on unnecessary features. Look for AI stock market software that aligns with your strategy to save time and effort later. Move forward by comparing pricing plans next.

Compare Pricing Plans

After determining your trading objectives, choosing software with appropriate pricing becomes essential. Here’s a concise comparison of plans for well-known AI stock market tools:

| Software | Monthly Price | Annual Price | Free Version |

|---|---|---|---|

| TrendSpider | $48 | $107 | No |

| Trade Ideas | $254 | $178 | No |

| Finviz | Free (basic) | – | Yes |

| TradingView | $14.95 to $59.95 | $155.40 to $599.40 | Yes |

| Tickeron | Varies by model | Varies by model | No |

Concentrate on the features you require, not just the price. For example, beginners might favor budget-friendly tools such as TradingView or Finviz.

Look for Beginner-Friendly Features

Pick platforms with user-friendly interfaces like TradingView and TC2000. These make stock trading simpler for beginners without complex layouts or tools.

Check for clear charts, easy navigation, and customizable alerts. Finviz offers free screening tools, while TrendSpider focuses on technical analysis features suitable for first-time users.

Check for Customer Support Options

Most AI stock trading platforms should offer quick customer support. Reliable systems provide live chat, email, or 24/7 help desks. Trading errors can cost money, so fast responses matter.

Join software with active user forums or trading communities. Platforms like TradingView often have these groups for advice and tips. A strong community adds extra guidance for beginners.

Always test the support features before committing to a platform.

Tips for Using AI Stock Market Software Effectively

Test the software with a demo account before using real money. Keep track of how it performs and adjust your trading strategies as needed.

Start with a Demo Account

Use demo accounts to practice stock trading without risk. Many platforms, like TradingView or the Robinhood app, offer these free tools. They help you understand automated trading tools and real-time market analysis.

A demo account simulates real markets using virtual money. Test predictive analytics and customizable alerts while building your skills. Save time learning new strategies before investing actual funds.

Monitor Performance Regularly

Track the performance of your AI stock trading software daily. Review metrics like win-loss ratios and profit margins to spot patterns. Adjust trading strategies if trends show weaker returns.

Use real-time analytics tools for instant updates on market shifts. Test new settings in demo accounts before applying them live. This avoids potential losses while improving results over time.

Combine AI Insights with Your Research

Use AI-generated insights as a helpful tool, but rely on your expertise as well. AI can efficiently review technical charts or trends in social media sentiment, yet human judgment leads to better decisions.

While predictive analytics may point out potential gains in Bitcoin, consider news events or market conditions before proceeding.

AI tools save time by examining extensive data for patterns, such as dark pool trades or operating system impacts on stocks. They combine these findings with fundamental analysis to evaluate their significance.

This leads to more accurate and calculated trading.

Challenges of AI Stock Market Software

AI trading tools can be costly and rely heavily on data accuracy—but understanding these limits can help users make smarter choices.

Understanding Limitations of AI Predictions

AI bots rely on timely and precise data. Unexpected events or significant market shifts can disrupt their predictive models. For instance, AI may face challenges in adapting swiftly during a financial crisis.

Stock predictions from AI are not consistently accurate. Emotional factors or social media sentiment may influence stock prices in ways AI cannot anticipate. Traders should integrate AI tools with their judgment and research to improve outcomes.

Managing Software Costs

Software prices for stock trading tools can range from $48 to $250 monthly. Compare features to the cost and decide if it meets your trading goals.

Pick plans with beginner-friendly options like push notifications or fundamental analysis tools. Watch out for hidden fees in services like portfolio management or add-ons such as social media sentiment tracking.

Avoiding Over-Reliance on Automation

Human intervention is crucial during high-risk trading periods. AI-based tools, while powerful, can misinterpret sudden market shifts or social media sentiment changes. Relying solely on predictive analytics may lead to losses during volatile times.

Data-driven insights should support decisions but not replace fundamental or technical analysis. Review your portfolio management strategies regularly and manually cross-check automated results for accuracy.

Always combine automation with personal research to minimize risks.

Conclusion

AI stock market software has transformed trading by making advanced analytics accessible to both beginners and experienced traders. These tools leverage artificial intelligence to automate trading, predict market trends, and streamline decision-making. From features like automated trading and real-time market analysis to customizable alerts and portfolio management, AI-powered platforms reduce the manual effort required while improving accuracy and efficiency.

Platforms such as Tickeron, TrendSpider, and Trade Ideas offer diverse capabilities tailored to different trading styles and goals. While these tools provide significant advantages, such as faster decision-making and reduced emotional trading, they also require careful consideration of costs, learning curves, and reliance on automation.

In summary, AI trading software is essential for navigating today’s competitive markets. By combining the power of AI with personal research and strategy, traders can make more informed decisions, manage risks effectively, and gain a competitive edge in stock trading.

Frequently Asked Questions

What is AI stock market software, and how does it help beginners?

AI stock market software uses artificial intelligence to analyze data like social media sentiment, technical analysis, and fundamental analysis. It helps beginners identify patterns, suggest trading strategies, and improve portfolio management.

Can I use AI for stock trading on mobile devices?

Yes, you can! Stock trading app development often includes features like push notifications, multi-factor authentication for security, and compatibility with operating systems like Android.

How secure are these apps for trading stocks?

Most apps include SSL encryption to protect your data. They also use tools like cross-site scripting (XSS) prevention and regular security audits to ensure compliance with safety standards.

Do these platforms support additional tools for analysis?

Yes—many apps integrate Google Analytics or offer tracking cookies to understand user preferences better. They also provide valuation tools and insights from hedge funds or analysts.

What programming frameworks are used in building such applications?

Developers commonly use JavaScript frameworks for the front end and Ruby on Rails for web development when creating user-friendly interfaces with strong UI/UX design.