The stock market is a dynamic and complex system influenced by economic indicators, investor behavior, and global events. Predicting major market movements, such as stock market crashes, has long been challenging for investors and analysts. Artificial Intelligence (AI) is emerging as a powerful tool to address this complexity, offering advanced capabilities to analyze and interpret market data.

By leveraging technologies like machine learning, natural language processing, and neural networks, AI can process vast amounts of historical and real-time information. It identifies patterns and anomalies that may signal a potential market downturn. AI systems analyze various factors, including price trends, trading volumes, and news sentiment, to detect early warning signs.

This data-driven approach enhances investors’ and institutions’ ability to manage risks and respond proactively. While AI cannot guarantee precise predictions, it provides valuable insights into market behavior. As technology advances, its role in forecasting and mitigating the impact of stock market fluctuations is set to grow.

Key Takeaways

- AI detects subtle market changes, providing timely alerts that enable proactive risk management and decision-making.

- Generative Adversarial Networks (GANs) refine market predictions by generating synthetic data, improving the reliability of forecasts.

- Long Short-Term Memory Networks (LSTMs) excel in analyzing historical data and forecasting future trends, making them highly effective for predicting market crashes.

- AI evaluates news, social media, and reports to gauge investor sentiment, aligning investment strategies with market dynamics.

- AI identifies recurring patterns and anomalies in trading behaviors, price movements, and market sentiment to anticipate potential downturns.

- AI tools empower investors to mitigate risks by providing data-driven insights into market conditions and potential disruptions.

- AI processes vast amounts of data efficiently, ensuring timely and actionable market predictions for institutions and individual investors.

- Combining AI insights with financial experts’ contextual understanding ensures predictions are accurate and actionable.

- AI is versatile and can analyze different market types, including equities, commodities, and foreign exchange.

- AI models evolve over time, learning from new data to refine predictions and enhance forecasting capabilities.

How AI Analyzes Stock Markets

AI is transforming financial markets through its ability to process vast amounts of data and uncover patterns that inform decision-making. Machine learning algorithms, a cornerstone of AI, analyze both historical and real-time data to identify trends, detect anomalies, and highlight recurring patterns.

These algorithms continuously improve as they process more information, enabling deeper insights into market behavior. Neural networks mimic the human brain’s learning process and play a crucial role by finding intricate relationships within datasets, offering a sophisticated understanding of financial trends.

One of AI’s strengths is its ability to analyze diverse data points, making it an invaluable tool for financial markets. Historical trends, for example, provide a foundation for understanding market patterns and cycles. By studying these trends, AI can detect correlations that inform future forecasts.

Another critical area of analysis is real-time fluctuations. AI systems monitor trading volumes, price movements, and order flows as they happen, enabling real-time decision-making and risk management.

Additionally, AI employs natural language processing (NLP) to analyze news sentiment and public opinion. AI gauges the market’s mood by evaluating headlines and social media discussions, identifying shifts that could influence trading behavior.

Through its multifaceted approach, AI enhances investors’ and institutions’ ability to navigate complex financial landscapes with precision and efficiency.

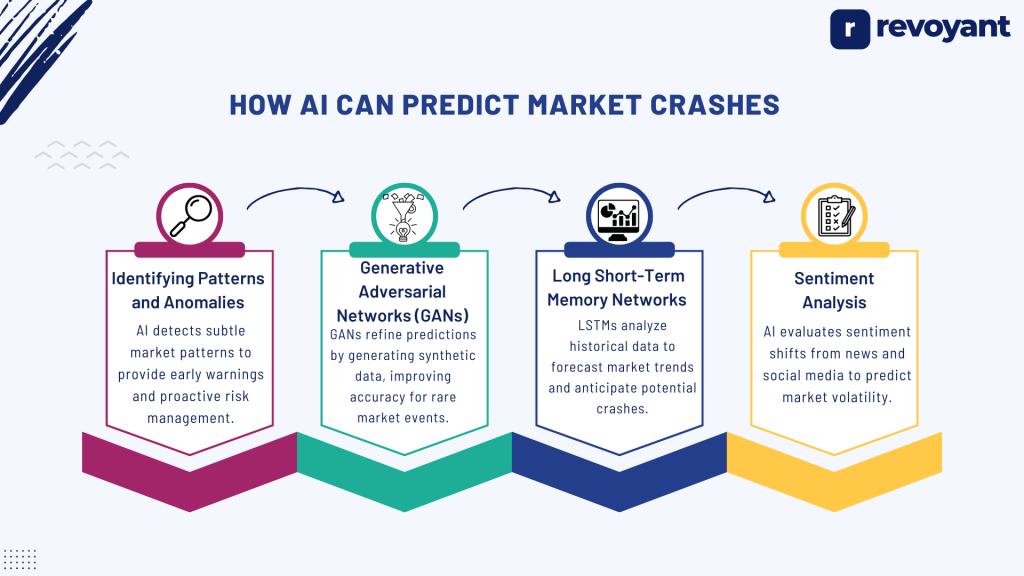

How AI Can Predict Market Crashes

Identifying Patterns and Anomalies

AI excels at analyzing subtle changes in trading behaviors, price movements, and sentiment shifts that may signal a market crash. By detecting these patterns and anomalies, it provides early warnings to investors. These insights enable proactive risk management and timely decision-making.

This capability helps investors prepare more effectively for potential downturns. The result is a data-driven approach to navigating market complexities.

Generative Adversarial Networks (GANs)

GANs improve market predictions by generating synthetic data for testing and refining models. The generator creates data while the discriminator evaluates its accuracy, leading to better predictions. This iterative process ensures AI systems continuously improve their reliability.

GANs are particularly useful for detecting rare market events. By enhancing model accuracy, GANs contribute to more precise forecasts.

Long Short-Term Memory Networks (LSTMs)

LSTMs specialize in analyzing historical market data to predict future trends and potential crashes. These models process sequential information, identifying patterns across time. Their memory-based design makes them highly effective for time-series forecasting.

LSTMs help investors anticipate market movements and timing changes. They are widely used for creating actionable, data-driven financial strategies.

Sentiment Analysis

AI leverages natural language processing (NLP) to evaluate public and investor sentiment from news, reports, and social media. Analyzing mood shifts identifies trends that might affect market stability. Sudden sentiment changes often signal potential volatility or downturns.

This analysis enhances investors’ ability to align strategies with market dynamics. Sentiment analysis bridges quantitative data with qualitative insights for comprehensive forecasting.

Benefits of Using AI in Stock Market Predictions

Risk Management for Investors

AI provides investors with data-driven insights that enhance risk management strategies. By analyzing complex datasets, it identifies potential market risks early, enabling proactive decisions to safeguard portfolios.

This capability supports better diversification and helps minimize the impact of market fluctuations.

Enhanced Decision-Making

AI’s ability to process vast amounts of data translates into clear, actionable insights. These insights empower institutional and individual investors to navigate complex market dynamics confidently.

By highlighting opportunities and potential risks, AI enables informed decision-making that aligns with investment goals.

Scalability and Speed

One of AI’s most significant advantages is its ability to work in real-time. It processes extensive datasets rapidly, delivering timely insights that allow investors to respond quickly to market changes. This scalability makes it ideal for handling large volumes of data, ensuring that opportunities and risks are addressed as they arise.

AI’s speed and precision offer a competitive edge, helping investors stay ahead in fast-paced financial markets. By combining risk management, decision-making support, and real-time responsiveness, AI transforms how investors approach market predictions and strategies.

Challenges AI Faces in Predicting Market Crashes

Balancing Data and Context

AI effectively analyzes vast datasets, uncovering trends and patterns in historical and real-time information. However, these insights often need human interpretation to align with broader market contexts and nuances. Financial markets are influenced by variables, such as geopolitical events or investor psychology, that AI alone may not fully capture.

Collaborative efforts between AI systems and human experts enhance the relevance and applicability of predictions. This synergy ensures that AI-generated insights lead to informed and strategic decision-making.

Ethical and Transparency Considerations

The growing use of AI in financial markets highlights the importance of ethical guidelines and transparency. Investors and stakeholders need clarity on how AI systems process data and generate predictions. Transparent models build trust and encourage the responsible use of AI for market analysis.

Establishing clear regulations can prevent misuse and ensure fairness in decision-making processes. Ethical AI practices promote accountability while supporting innovation in financial forecasting.

The Future of AI in Stock Market Predictions

Hyper-Accurate Predictions

Advancements in AI models are enhancing their ability to detect even more intricate and subtle patterns in market data. These improvements will enable highly accurate forecasts of market trends and potential disruptions. AI systems will likely integrate deeper learning techniques, offering nuanced insights tailored to specific scenarios.

This precision can significantly enhance risk assessment and investment strategies, allowing investors to make more confident and informed decisions.

3D Market Simulations

AI is paving the way for interactive 3D market simulations visually representing market trends and scenarios. These simulations give investors a clearer understanding of potential outcomes under varying conditions. By modeling real-time data, investors can test strategies and predict the impact of economic or geopolitical shifts.

This immersive approach allows for better risk evaluation and scenario planning. It will become an essential tool for both institutional and individual investors.

Democratization of Financial Insights

AI tools are becoming more accessible, empowering individual investors with professional-grade insights. These advancements reduce the gap between retail and institutional investors, fostering a more inclusive financial ecosystem.

Affordable and user-friendly platforms will enable individuals to analyze market trends and make data-driven decisions. The availability of AI insights can enhance financial literacy and strategic planning. Democratized AI tools will level the playing field in investment opportunities.

Real-World Examples of AI in Stock Markets

Algorithmic Trading Platforms

AI-driven algorithmic trading platforms are revolutionizing how trades are executed in stock markets. Platforms like Kavout leverage machine learning to analyze historical and real-time data, enabling them to quickly identify profitable opportunities and execute trades. These platforms use predictive models to spot patterns and anomalies that indicate potential market movements.

Automating trading strategies reduces human error and allows investors to respond swiftly to changing market conditions. Algorithmic trading now accounts for a significant portion of daily trading volumes in global stock markets, highlighting its efficiency and effectiveness.

Predicting Stock Price Movements

AI systems are being used to forecast stock price movements with increasing accuracy. Companies like Numerai apply machine learning models to analyze vast datasets, including market trends, historical prices, and macroeconomic indicators.

These AI models are particularly adept at identifying patterns that traditional methods might overlook. By combining these insights with human expertise, firms can make informed decisions about buying, selling, or holding stocks. This blend of AI and human analysis enhances portfolio management and mitigates risks.

Sentiment Analysis for Market Trends

AI-powered sentiment analysis tools like Accern and AlphaSense monitor public and investor sentiment. By analyzing news articles, social media posts, and financial reports, these tools provide insights into market mood and potential shifts in stock prices.

For example, a sudden surge in positive sentiment about a company may indicate an upward price trend, while a spike in negative sentiment could signal a potential downturn. These insights enable investors to align their strategies with market dynamics more effectively.

Institutional Adoption of AI

Leading financial institutions such as JPMorgan Chase and Goldman Sachs have integrated AI into their operations. JPMorgan’s AI tool, LOXM, optimizes trading by predicting the best way to execute large orders without impacting market prices.

Similarly, Goldman Sachs uses AI for risk management and market predictions, helping it stay competitive in a fast-paced industry. These institutions demonstrate how AI can enhance efficiency and decision-making in large-scale financial operations.

AI-Powered ETFs

Exchange-traded funds (ETFs) powered by AI, like AIEQ, use machine learning algorithms to analyze thousands of data points daily. These ETFs select and manage portfolios based on data-driven predictions, offering investors a modern approach to market participation.

AI’s real-world applications are redefining the stock market, making it more efficient, data-driven, and accessible.

Conclusion

AI is shaping the future of finance, offering advanced tools for analysis, prediction, and decision-making. Its potential to transform market strategies, foster inclusivity, and improve efficiency is immense.

However, its true value lies in combining technological precision with human judgment, ensuring ethical, transparent, and effective applications in dynamic financial systems.

Frequently Asked Questions

Can AI predict stock market crashes accurately?

AI technology, including algorithmic trading and linear models, can analyze data to identify patterns. However, its predictions lack full robustness due to unpredictable human behavior and economic factors.

What role do algorithms play in predicting market trends?

Algorithms use technical analysis and systematic reviews to process large datasets quickly. They aim to find predictors of potential crashes but require robust statistical methods for reliability.

How does personalization impact AI’s ability in the stock market?

Personalization through cookies or tax-planning optimization can tailor insights for users—but it doesn’t guarantee accurate crash predictions since markets are highly complex.

Are there limitations with AI tools like ChatGPT in financial forecasting?

Yes, while tools like ChatGPT provide knowledge and rational insights, they’re not designed for detailed meta-analyses or methodological evaluations necessary for precise stock predictions.