AI-powered technical analysis transforms stock trading by combining advanced algorithms with market data to deliver actionable insights. This innovative approach leverages machine learning, deep learning, and natural language processing to analyze patterns, trends, and market behavior with exceptional precision. AI tools offer traders a comprehensive view of market dynamics by processing vast datasets, including historical prices, trading volumes, and even social media sentiment.

Unlike traditional technical analysis, which often relies on manually interpreting charts and indicators, AI automates the process, making it faster and more efficient. Algorithms can identify complex patterns, predict price movements, and even adapt to changing market conditions, enabling traders to make well-informed decisions.

From individual investors to institutional traders, AI tools have become essential in crafting strategies, managing portfolios, and identifying lucrative opportunities. As these technologies evolve, their applications continue to grow, enhancing accuracy and efficiency in stock trading. AI-powered technical analysis represents a significant leap forward, empowering traders with tools to navigate markets confidently and quickly.

Key Takeaways

- AI-driven technical analysis enhances trading accuracy by identifying patterns like moving averages and Bollinger Bands quickly and efficiently.

- AI processes vast datasets in real time, providing actionable insights from financial news, market sentiment, and historical data.

- AI tools implement predictive modeling, stop-loss orders, and stress testing to minimize risks and safeguard investments during volatile periods.

- AI handles large-scale tasks like high-frequency trading and portfolio management without disruptions, operating 24/7.

- AI eliminates emotional biases like fear or greed, ensuring consistent, rule-based decision-making for better trading outcomes.

- Combining AI’s data-driven insights with human intuition creates a balanced strategy, leveraging the strengths of both for smarter investments.

- AI reduces operational costs by automating repetitive tasks and optimizing workflows, allowing firms to focus on strategic trading activities.

- AI is redefining stock trading, offering smarter, faster, and more adaptable solutions for traders and investors alike.

What is AI-Powered Technical Analysis?

AI-powered technical analysis leverages artificial intelligence to analyze market trends and predict stock price movements precisely. It processes extensive datasets, including historical prices, candlestick charts, moving averages, and news, delivering actionable insights in seconds.

By utilizing machine learning algorithms, AI identifies patterns and trends that may not be immediately apparent to human analysts. This allows traders to detect potential buy or sell signals more efficiently, optimizing decision-making in dynamic markets.

AI-powered systems also incorporate sentiment analysis and real-time processing to assess market sentiment and trader behavior. By scanning social media posts, financial reports, and other sources, these tools provide a comprehensive understanding of market dynamics. Indicators like Bollinger Bands and the Relative Strength Index (RSI) benefit from AI integration, enhancing their accuracy and reliability.

With these advanced insights, technical analysts can refine their trading strategies, capitalize on opportunities, and manage risks more effectively. AI-powered technical analysis reshapes how traders approach the market, offering speed, precision, and adaptability for improved outcomes.

Key Features and it’s Benefits of AI in Technical Analysis

AI in technical analysis leverages advanced tools to analyze stock data, identify trends, evaluate market sentiment, and predict price movements quickly and precisely.

| Feature | Description | Benefits |

|---|---|---|

| Data Mining | Processes large datasets to identify trends like bullish or bearish movements using historical data. | Uncovers patterns in price fluctuations, moving averages, and Bollinger Bands to support trading strategies. |

| Sentiment Analysis | Analyzes investor sentiment through news, social media, and forums using NLP to evaluate emotional indicators. | Highlights market sentiment shifts and supports the development of targeted trading strategies. |

| Real-Time Analysis | Tracks financial markets 24/7, processing data instantly to detect emerging trends and opportunities. | Enables faster decision-making, monitors multiple stocks, and delivers actionable trading signals. |

| Predictive Modeling | Uses machine learning to analyze historical patterns like moving averages and RSI to forecast price movements and potential market behavior. | Enhances accuracy in forecasting trends, supports automated trading, and improves portfolio management. |

Data Mining

Data mining processes extensive datasets to uncover meaningful patterns. In the stock market, it detects trends like bullish or bearish movements by analyzing historical data. AI systems efficiently analyze big data to reveal price fluctuations and shifts in market sentiment.

These tools enhance technical analysis by quickly identifying indicators like moving averages and Bollinger Bands. Traders utilize this information to develop effective strategies, while machine learning continuously improves prediction accuracy.

Sentiment Analysis

AI-driven sentiment analysis evaluates market sentiment by examining news, social media, and online discussions. Using natural language processing (NLP), it interprets text for emotional cues, helping to gauge investor opinions.

This analysis helps identify trends; for instance, a bullish sentiment may emerge when a company receives widespread positive feedback. These insights guide trading strategies by highlighting shifts in market sentiment.

Real-Time Analysis

AI processes large volumes of data instantly, enabling faster decision-making in stock trading. Real-time analysis continuously monitors financial markets and quickly identifies new trends. This enhances efficiency by tracking multiple stocks simultaneously and delivering timely insights.

Trading systems apply tools like moving averages or RSI to generate actionable signals, allowing traders to respond swiftly and capitalize on opportunities.

Predictive Modeling

Predictive modeling anticipates stock trends by analyzing historical data. Machine learning algorithms evaluate patterns, such as moving averages and RSI, to forecast price movements accurately.

These models process vast amounts of data to provide actionable insights for investors. Predictive analytics highlights potential gains and supports strategies like automated trading and portfolio management.

For example, deep learning models forecast how market sentiment influences stock prices, helping traders refine their approaches. These tools evaluate metrics like Bollinger Bands and stop-loss orders, enhancing risk management and decision-making.

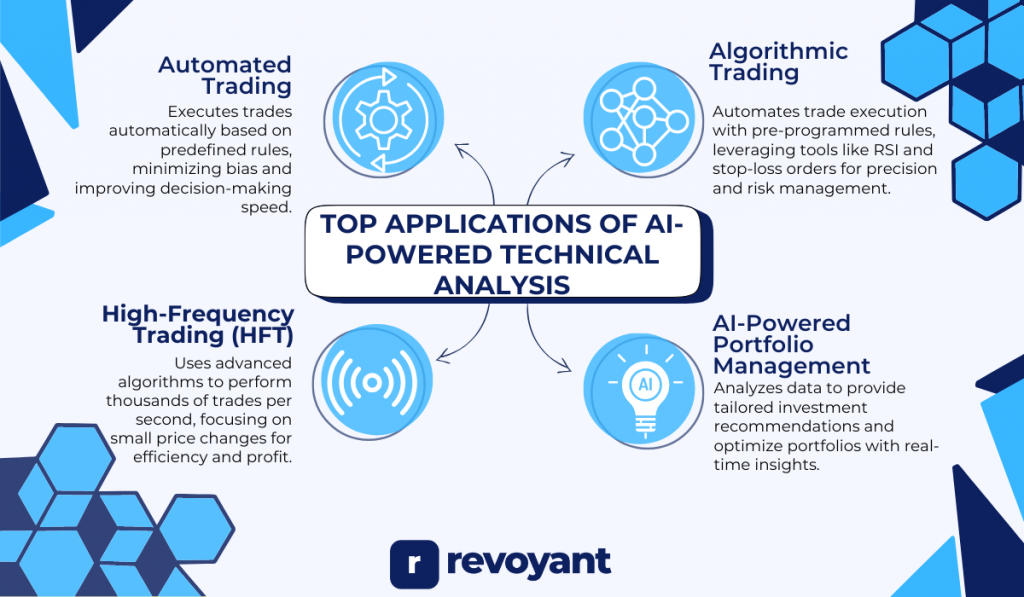

Top Applications of AI-Powered Technical Analysis

AI has revolutionized stock trading, streamlining processes for buying, selling, and managing assets with greater efficiency and precision.

Automated Trading

Automated trading enables the execution of trades based on predefined rules, eliminating the need for manual intervention. AI-driven algorithms evaluate technical indicators like moving averages or Bollinger Bands and execute trades quickly and efficiently.

This approach minimizes emotional bias and accelerates decision-making. Automated trading also reduces costs by processing tasks faster than traditional methods. High-frequency strategies, which demand speed and precision, benefit greatly from real-time analysis and predictive modeling.

High-Frequency Trading (HFT)

High-frequency trading utilizes advanced algorithms to perform thousands of trades per second. Leading firms like Charles Schwab and Fidelity employ these systems to maintain a competitive edge.

HFT excels in fast-paced markets, focusing on small price changes by analyzing historical and real-time data. Tools such as Bollinger Bands and moving averages help identify opportunities rapidly. This method enhances efficiency, reduces manual errors, and generates profits in milliseconds, making it a preferred strategy for intraday trading and large-scale transactions.

Algorithmic Trading

Algorithmic trading uses pre-programmed rules to execute trades automatically. Algorithms analyze historical data, market trends, and indicators like the Relative Strength Index (RSI) and moving averages.

These systems operate faster than human traders, enabling quick decisions with precision. Approximately 70% of U.S. stock market trades are powered by algorithmic trading, which integrates tools like stop-loss orders to manage risks. AI-powered algorithms adapt and improve as they process more data, enhancing performance over time.

AI-Powered Portfolio Management

AI enhances portfolio management by analyzing historical data to predict stock trends and evaluate portfolio performance. It provides precise recommendations on buying, selling, or holding stocks based on market conditions.

This reduces errors and improves efficiency in managing investments. Investors benefit from tailored suggestions for mutual funds, equities, or fixed-income securities. AI tools also streamline risk management through real-time analysis, offering valuable insights for portfolio optimization.

AI-powered technical analysis continues to redefine stock trading strategies, enabling faster, smarter, and more accurate financial decisions.

Benefits of AI in Technical Analysis

AI empowers traders by rapidly analyzing data, identifying patterns, and delivering actionable insights. It enhances trading strategies and supports better decision-making.

Improved Accuracy

AI enhances accuracy in technical analysis by eliminating manual errors and processing large datasets like historical prices and market sentiment. Machine learning models identify patterns quickly and deliver precise predictions, refining trading strategies.

Predictive modeling boosts accuracy significantly, while real-time analysis ensures traders act on timely signals. With AI integration, indicators such as moving averages, RSI, and Bollinger Bands become even more effective, offering sharper insights for improved results.

Pattern Forecasting

AI excels in forecasting recurring market patterns through advanced predictive modeling. AI uncovers hidden trends by analyzing historical data, real-time factors like news or social media sentiment, and technical indicators.

Machine learning processes large datasets swiftly, combining technical and sentiment analysis to predict future movements accurately. Traders use these forecasts to develop strategies, optimize performance, and manage risks confidently.

Risk Management

AI-powered tools support risk management by analyzing historical data and simulating potential losses through stress testing. Predictive modeling evaluates trading strategies, allowing traders to make informed decisions before executing trades.

Features like stop-loss orders and AI-generated trading signals safeguard investments during volatile periods. Real-time analysis detects market changes early, helping traders minimize risks and maintain stable portfolios.

Reduced Costs

AI automation reduces operational costs by streamlining repetitive tasks and optimizing workflows. Firms save on staffing expenses, enabling employees to focus on strategic activities.

Automated trading systems cut costs further by processing transactions faster and more efficiently. Real-time analysis and predictive modeling eliminate delays, improving overall productivity while lowering financial barriers for firms in competitive markets.

AI-driven technical analysis offers smarter, faster, and more cost-effective solutions, reshaping how traders and firms approach the stock market.

Comparison of Human vs. AI-powered trading

| Aspect | Human Trading | AI-Powered Trading |

|---|---|---|

| Emotional Bias | Decisions often influenced by emotions like fear or greed, leading to inconsistencies and higher risk. | Rule-based systems eliminate emotions, ensuring logical and consistent trading decisions. |

| Decision-Making Process | Relies on intuition, personal experience, and manual analysis of market trends. | It uses predictive modeling, sentiment analysis, and data-driven strategies to make precise and timely decisions. |

| Consistency | Performance varies due to emotional stress, fatigue, or external factors. | Ensures steady performance by analyzing market data uniformly, unaffected by external influences. |

| Scalability | Limited ability to process large datasets or handle multiple markets simultaneously. | Efficiently manages massive datasets, trading signals, and real-time analysis for large-scale tasks. |

| Availability | Works during market hours but requires breaks and downtime. | Operates 24/7 without interruptions, continuously analyzing data and generating insights. |

| Risk Management | Risk assessment may be subjective and influenced by emotions. | Implements automated stop-loss orders and stress-tested strategies to minimize risk. |

| Application Areas | Best suited for manual trading and strategy development. | Excels in algorithmic trading, automated portfolio management, and high-frequency trading. |

Conclusion

AI-powered trading is transforming the landscape of stock market investments, offering distinct advantages over human trading by eliminating emotional biases and delivering consistent, data-driven decisions. While human traders bring intuition and experience to the table, they can be influenced by emotions such as fear and greed, which may lead to inconsistent results or missed opportunities. In contrast, AI operates on predefined rules and algorithms, ensuring logical, precise, and reliable trading strategies.

The scalability and speed of AI systems allow for the processing of massive datasets and real-time market analysis, something that humans find challenging to achieve at the same pace. With tools like predictive modeling and sentiment analysis, AI-powered trading systems excel in handling complex market dynamics, enhancing risk management, and optimizing portfolio performance.

However, it’s important to note that AI and human trading are not mutually exclusive. Combining AI’s analytical capabilities with human judgment creates a powerful synergy. As AI technology continues to evolve, it is poised to play an increasingly significant role in the financial world, shaping the future of trading with efficiency, precision, and adaptability.

Frequently Asked Questions

What is AI-powered technical analysis in stock trading?

AI-powered technical analysis uses artificial intelligence and machine learning to study historical data, predict trends, and generate trading signals for financial markets.

How does AI improve trading strategies?

AI enhances trading strategies by using predictive modeling, real-time analysis, and data mining to identify patterns like moving averages or Bollinger Bands while considering market sentiment.

Can AI help with risk management in stock trading?

Yes, AI can assist with risk management by analyzing behavioral economics, running simulations for stress testing, and setting stop-loss orders based on historical data.

What tools are used in AI-driven technical analyses?

Common tools include the Relative Strength Index (RSI), simple moving averages, Bollinger Bands, and automated trading systems that combine valuation techniques with sentiment analysis.

Is AI suitable for beginners in stock trading?

Yes! Many educational websites and online courses offer user-friendly applications of artificial intelligence to teach fundamental analysis through visualization tools and model training.

Does AI replace human judgment in investing?

No—while it automates processes like appraisal or identifying investment products efficiently, human oversight is needed to interpret results within broader market contexts like market sentiments or economic shifts.