Artificial Intelligence (AI) has revolutionized the way stock market trends are analyzed and predicted. By leveraging vast amounts of historical data, market patterns, and real-time information, AI-powered systems provide traders and investors with deeper insights and actionable predictions.

Unlike traditional methods, which rely on manual analysis or static models, AI utilizes advanced algorithms such as machine learning and natural language processing to identify subtle patterns and relationships within the data. These systems can process large datasets with remarkable speed and precision, enabling them to adapt to market fluctuations and uncover trends that may not be immediately apparent.

Additionally, AI integrates sentiment analysis from news articles, social media, and financial reports to gauge the market’s psychological landscape. This comprehensive approach allows AI to provide a more holistic view of potential market movements. While it doesn’t guarantee results, the use of AI in stock market analysis enhances decision-making, reduces guesswork, and empowers both individual and institutional investors to navigate complex financial markets with confidence.

Key Takeaways

- AI analyzes large datasets to identify patterns and refine predictive models using machine learning.

- Real-time processing of financial news, social media sentiment, and economic indicators enables swift, informed decisions.

- Neural networks, LSTM, and GRU excel in recognizing complex trends and time-series patterns for improved accuracy.

- Sentiment analysis evaluates public opinions and emotions from news and social media to enhance market forecasts.

- Startups and large firms use AI for portfolio management, high-frequency trading, and predictive analytics.

- AI efficiently handles vast historical and real-time data, making it ideal for large-scale operations.

- Continuous innovation positions AI as a key driver of smarter, data-driven stock market strategies and investments.

Key Concepts in AI Stock Market Prediction

AI employs sophisticated methods to analyze and predict stock trends. These techniques uncover patterns within data, enabling smarter and more informed trading decisions.

Machine Learning Algorithms

Machine learning algorithms are vital in forecasting stock prices by recognizing patterns within extensive market data. These methods analyze historical prices, trading volumes, and other relevant factors to estimate future market trends.

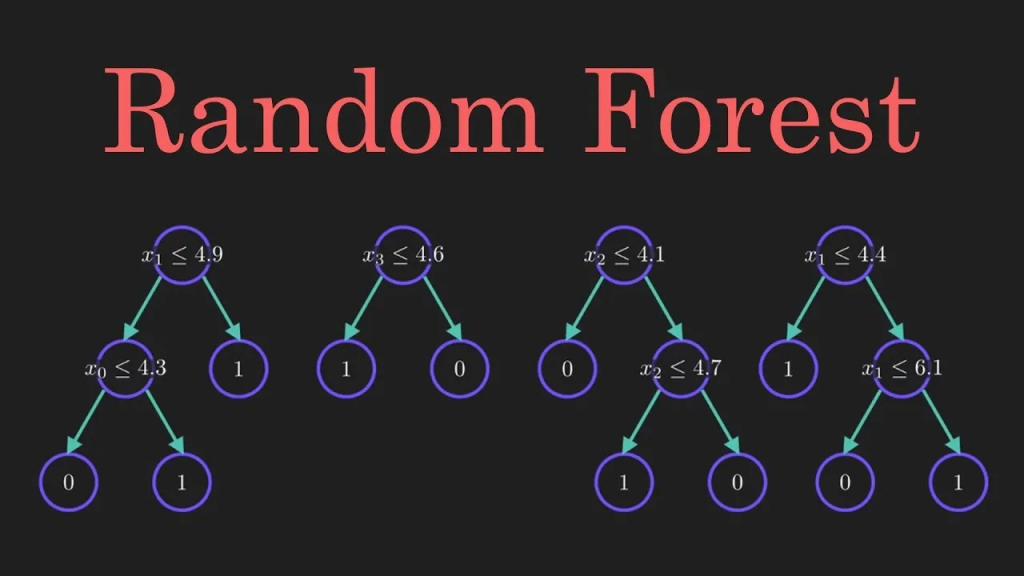

Popular algorithms like Random Forest and Support Vector Machine (SVM) are highly regarded for their precision in classification tasks. Linear regression models also contribute significantly by examining the relationships between variables influencing stock values.

These techniques are widely applied in high-frequency trading and portfolio management. For instance, machine learning can process thousands of trades per second, identifying investment opportunities with exceptional speed and accuracy.

Gartner anticipates that by 2025, 75% of businesses will incorporate AI technologies, including machine learning, to enhance decision-making in dynamic market environments. Machine learning’s effectiveness lies in its ability to derive actionable insights from complex datasets.

Deep Learning Techniques

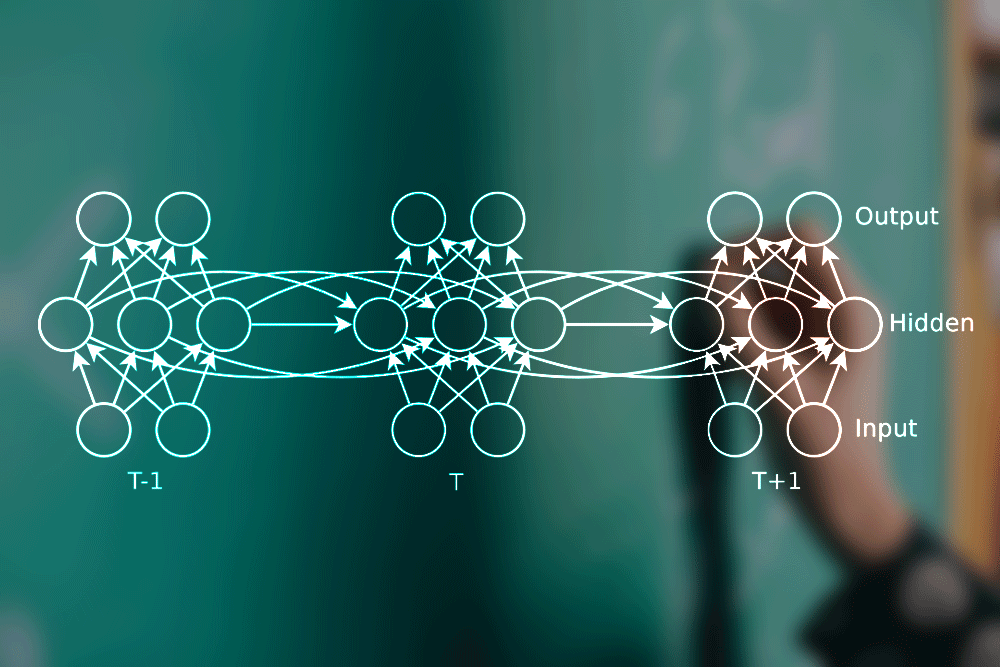

Deep learning techniques enhance stock market predictions by leveraging advanced neural network architectures. Long-short-term memory (LSTM) networks are particularly effective in analyzing time-series data and uncovering patterns over extended periods.

For example, historical data such as Google stock trends from 2012 to 2016 can be used to train an LSTM model to identify potential future patterns.

Recurrent Neural Networks (RNNs) are also instrumental in this field. Unlike traditional models, RNNs utilize past outputs to refine their predictions. These methods help detect hidden market trends and improve the accuracy of predictive analytics.

These advanced tools empower traders to make well-informed investment decisions and develop robust risk management strategies.

Core AI Technologies Used in Stock Market Prediction

AI employs advanced tools to analyze and predict stock market trends. These technologies study patterns, sentiments, and data to support more informed trading decisions.

Natural Language Processing (NLP)

Natural Language Processing (NLP) enables AI to interpret financial news, social media content, and market-related articles. By processing human language, NLP provides actionable insights into factors influencing stock trends.

For instance, NLP can analyze large volumes of tweets and headlines to assess public sentiment about specific companies.

Through sentiment analysis, text is converted into meaningful data, helping traders identify opportunities and market shifts.

By combining historical data with predictive models, NLP detects changes in consumer behavior and economic signals. This enhances understanding of market sentiment and supports improved investment strategies.

Sentiment Analysis

Sentiment analysis leverages AI to assess emotions and opinions within text. It evaluates social media posts, news, and articles to determine market sentiment—whether investors are optimistic or cautious.

For example, tweets about a company’s strong performance can signal potential stock price growth.

AI tools efficiently process large datasets, including instant updates from platforms like Twitter, offering insights into market trends. These findings contribute to predictive analytics, improving trading decisions. Sentiment analysis categorizes emotions as positive, neutral, or mixed, equipping traders with valuable information for risk assessment and portfolio planning.

Integrating NLP with machine learning enhances prediction accuracy by combining historical data with real-time insights from public platforms.

Neural Networks

Neural networks mimic the workings of the human brain to recognize patterns in stock market data. They adjust internal “weights” to process large datasets and identify trends or forecast prices.

Advanced methods like Long-Short-Term Memory (LSTM) and Gated Recurrent Units (GRUs) excel at analyzing time-series data, which is essential for identifying stock price trends influenced by past performance. Neural networks uncover patterns that traditional methods may miss, providing valuable insights into potential market trends and risk factors.

These technologies integrate seamlessly with tools like NLP and sentiment analysis, evaluating multiple inputs such as social media and economic indicators. This combined approach enhances prediction accuracy. Neural networks remain pivotal in advancing stock market forecasting through AI-driven solutions.

Popular AI Models for Predicting Stock Market Trends

AI models are integral to predicting stock market trends, identifying patterns within data, and learning from historical events. These tools process vast amounts of information, enabling faster and smarter forecasting.

Long Short-Term Memory (LSTM) Networks

LSTM networks are highly effective for analyzing time-series data, making them ideal for stock market forecasting. They identify historical price and trend patterns, retaining critical information while filtering out less relevant details.

For example, an LSTM model with 32 units successfully predicted Microsoft’s stock behavior by leveraging past performance data.

These neural networks recognize trends and support accurate financial market predictions even under dynamic conditions.

Gated Recurrent Units (GRU)

Gated Recurrent Units (GRUs) are advanced neural networks designed for time-series analysis. With fewer training parameters compared to LSTM networks, GRUs are faster and less complex to train, making them a valuable asset in algorithmic trading.

GRUs analyze trends over time, including stock market movements and financial data patterns. They are particularly effective for short-term predictions, offering precision by identifying key economic indicators within historical datasets and real-time inputs like social media sentiment.

Their streamlined design provides robust predictive capabilities, making GRUs an excellent choice for AI-driven investment strategies and portfolio management.

Extreme Gradient Boosting (XGBoost)

XGBoost builds on decision tree algorithms to deliver precise stock market predictions. It is designed to handle large datasets efficiently, making it a go-to model for financial big data analysis.

Traders value XGBoost for its ability to process historical data and technical indicators seamlessly, uncovering hidden patterns that influence stock prices. It evaluates various factors, such as company performance and economic indicators, simultaneously ensuring comprehensive analysis.

With its speed and efficiency, XGBoost supports real-time decision-making, making it indispensable for high-frequency trading and automated trading systems. Financial analysts frequently use XGBoost for its reliable performance across both training and testing phases, ensuring consistent and accurate results.

Data Sources for AI Stock Market Analysis

AI relies on diverse data sources, including historical prices and financial news, to analyze and predict stock trends. These sources provide extensive information for AI models to study and generate insights. Let’s explore how this works!

Historical Stock Prices

Historical stock prices form the foundation for AI-driven market predictions. Machine learning models identify essential trends and patterns by analyzing past data, such as Google’s stock prices from January 3, 2012, to December 30, 2016.

These datasets, often available in CSV files, include details like opening prices, closing prices, trading volumes, and highs and lows. AI-powered systems use this structured information to simulate potential future movements in stock trading, supporting well-informed decision-making.

Financial News and Articles

Financial news and articles provide valuable insights into market sentiment. AI tools, particularly Natural Language Processing (NLP), review vast amounts of content daily to extract data relevant to stock movements.

These tools analyze headlines and reports’ tone, keywords, and content. For instance, positive earnings announcements often correlate with increased share prices.

Sentiment analysis further enriches this process by interpreting the emotional tone of news. Favorable coverage can boost a company’s stock value, while changes in sentiment may indicate shifts in market behavior.

AI-powered insights from financial news enable traders to craft effective strategies by integrating real-time data into their decision-making.

Social Media Sentiment

Social media platforms generate immense volumes of market-related opinions. AI utilizes this data to assess public sentiment toward stocks, leveraging Twitter, Reddit, and Facebook insights.

Whether positive or cautious, reactions on these platforms can signal potential market shifts.

Using NLP, AI models efficiently analyze posts, tweets, and comments. These tools can forecast emerging trends by identifying relevant words and phrases tied to companies or sectors.

For example, a surge in positive mentions about a new Apple product launch might indicate a potential rise in its stock price.

Neural networks enhance prediction accuracy by recognizing evolving patterns in social discussions, complementing traditional methods like historical data analysis. This integration provides a comprehensive approach to stock market forecasting.

Steps in AI-Based Stock Market Prediction

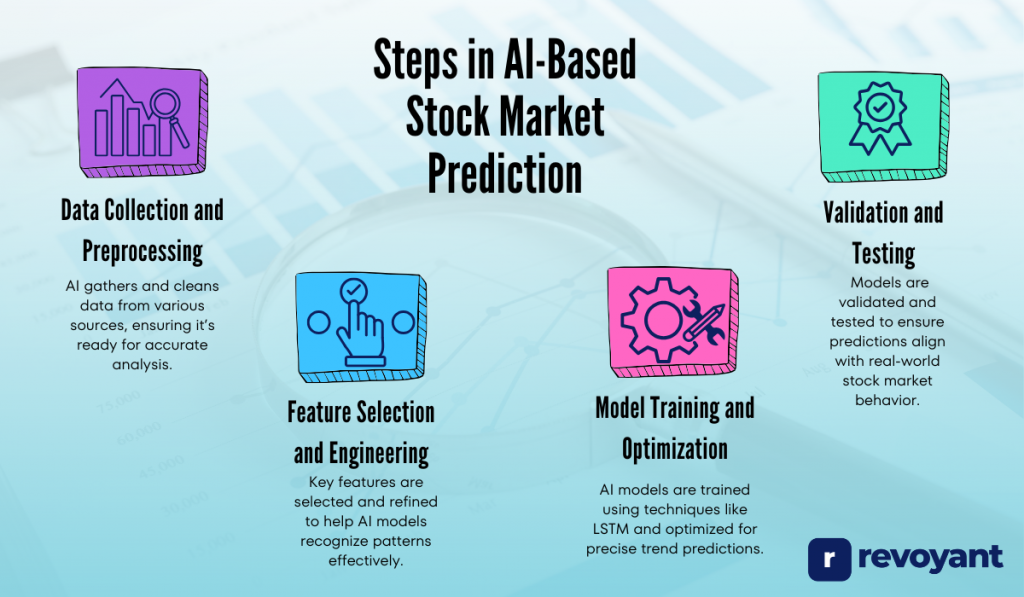

AI leverages large datasets to predict stock market trends, following structured steps to prepare, train, and test its models for precise forecasting.

Data Collection and Preprocessing

Stock market data is sourced from historical stock prices, financial news, and social media sentiment. Each data type provides unique insights, from identifying trends to understanding market sentiment.

These datasets are organized and prepared for AI models through cleaning and preprocessing. Scaling techniques, such as MinMaxScaler, normalize values between 0 and 1, improving the accuracy of machine learning algorithms during training. Proper preprocessing ensures clean and structured input, supporting effective feature selection and engineering in subsequent steps.

Feature Selection and Engineering

Selecting key features enhances the intelligence of AI models. Historical data, including stock prices and trading volumes, provides a reliable foundation, while real-time sources like financial news and social media trends refine predictions.

Feature selection removes less relevant information, streamlines training, and improves accuracy. Feature engineering creates new inputs like moving averages or volatility metrics derived from stock prices. Sentiment analysis quantifies text data into actionable metrics for predictive modeling.

These refined features enable AI models to interpret patterns better, accelerating learning and enhancing performance.

Model Training and Optimization

Once features are identified, the AI model undergoes training. For instance, LSTM networks, designed for time-series analysis, are trained with 100 epochs and a batch size of 8 to detect trends from historical data effectively.

Optimization techniques, such as gradient descent, adjust neural network weights to improve accuracy. Methods like regularization or dropout layers enhance model performance, ensuring robust learning. Fine-tuning during training supports accurate real-time decision-making in trading systems.

Validation and Testing

Validation ensures that predictions align with real stock prices. AI models compare forecasts with actual data to assess their effectiveness. By analyzing historical data, models verify their ability to recognize patterns that reflect market behavior.

Testing evaluates performance using a portion of the dataset, typically 10%, to simulate real-world scenarios. Accurate predictions on new data build confidence in AI tools like neural networks and XGBoost, making them valuable for trading and portfolio management.

Each step contributes to creating reliable AI models that accurately analyze and predict stock market trends.

How to Set Up AI Stock Market Software for Your Trading Strategy?

Benefits of Using AI in Stock Market Prediction

AI empowers investors to make well-informed decisions, quickly identify trends, and uncover patterns within extensive datasets. Here’s how AI enhances stock market predictions.

Enhanced Accuracy

AI significantly improves prediction accuracy by identifying patterns that may not be immediately visible to human analysts. Algorithms analyze vast volumes of historical data, financial news, and market trends in moments, refining their models through machine learning for greater precision.

AI-driven trading supports 60-73% of U.S. equity trades, highlighting its critical role in delivering accurate insights. Sentiment analysis processes social media posts and financial news, clearly showing public sentiment regarding stocks.

Neural networks excel in detecting intricate relationships within data, offering valuable insights into stock price movements.

Real-Time Decision-Making

Stock trading often requires quick, informed decisions. AI leverages real-time data to predict market trends instantly, analyzing social media sentiment, financial news, and live economic indicators with remarkable speed.

Neural networks and algorithms such as random forests process this information in seconds, enabling investors to respond promptly. High-frequency trading particularly benefits, as AI efficiently identifies patterns in rapidly changing markets while handling large datasets seamlessly.

This rapid processing helps investors adjust portfolios swiftly, assess risks accurately, and seize emerging opportunities with advanced tools like XGBoost and GRU models.

Identification of Hidden Patterns

AI uncovers hidden patterns in stock market data by applying machine learning and deep learning techniques. These tools recognize trends that may remain unnoticed through traditional analysis.

By analyzing past data, neural networks detect recurring patterns that inform risk evaluation and market behavior forecasts. Sentiment analysis of financial news offers insights into public opinion shifts that impact stock performance.

This capability allows AI to proactively reveal investment opportunities, giving investors a strategic advantage in identifying promising prospects ahead of others.

Challenges in AI Stock Market Prediction

While AI enhances stock market predictions, certain complexities must be addressed, particularly when navigating dynamic and rapidly evolving market conditions.

Data Volatility

Stock market data is highly dynamic, with prices shifting within seconds due to news, trading activities, or global events. AI models need to adapt to these rapid and unexpected changes effectively.

High-frequency trading adds another layer of complexity, as these systems process millions of transactions daily across major platforms like NASDAQ. While historical data provides a strong foundation for machine learning models, real-time adjustments are essential to maintain accuracy during sudden shifts.

Incorporating advanced risk management strategies ensures stable performance in highly dynamic trading environments.

Algorithmic Challenges

Unforeseen market events can pose challenges for even the most advanced AI systems. Events like the May 2010 flash crash highlight the importance of continuous improvement in predictive models. These scenarios underscore the need for AI systems to adapt quickly to unique or rare occurrences.

Balancing AI-driven analysis with human judgment is essential to maintain ethical considerations and informed decision-making in trading. Properly managed AI tools, combined with regulatory oversight, foster transparency and fairness in the market.

AI models also face challenges related to interpretability. While neural networks and deep learning techniques excel at pattern recognition, clearly articulating the rationale behind predictions remains an area of focus. Enhancing model transparency supports better risk assessment and informed strategies for investors.

Can AI predict stock market crashes? Read here.

Case Studies of AI in Stock Market Trends

AI has been instrumental in enhancing stock trading strategies. Companies, including startups, leverage advanced tools such as neural networks and sentiment analysis to identify market trends efficiently.

Successful Applications by Startups

Solio, a Korean startup, has successfully utilized robo-advisors to assist beginner traders. These tools analyze market trends and support portfolio management by applying machine learning algorithms for predictive analytics and strategic risk management.

Other startups integrate large language models (LLMs), like ChatGPT, to provide personalized financial insights. These systems enable investors to analyze real-time sentiment from social media and financial news. The widespread adoption of AI in the industry reflects a growing reliance on deep learning techniques for stock market predictions.

Industry-Wide AI Integration

Both large enterprises and startups are incorporating AI into their stock trading operations. AI empowers firms to process economic indicators, market trends, and real-time data with exceptional speed, supporting informed decision-making.

The fintech sector has experienced remarkable growth, with AI-based solutions reaching a value of $7.91 billion in 2021. High-frequency trading has particularly benefited from AI’s ability to uncover hidden patterns in historical data, enhancing trading precision.

Sentiment analysis of financial news and social media further enhances decision-making accuracy. Organizations can improve portfolio management and strengthen risk control strategies by integrating AI.

This progress underscores the importance of understanding specific algorithms and their applications, paving the way for continued innovation in stock market forecasting.

Conclusion

AI transforms stock market prediction by enabling faster, more accurate, and data-driven decision-making. Its ability to analyze vast datasets, detect hidden patterns, and incorporate sentiment analysis from real-time sources like financial news and social media makes it an indispensable tool for traders and investors.

From startups leveraging robo-advisors to large-scale industry adoption of machine learning and neural networks, AI redefines how markets are understood and navigated. While challenges such as data volatility and algorithmic transparency remain, technological advancements continue to address these complexities, paving the way for more reliable and robust solutions.

The integration of AI has enhanced trading strategies and improved risk management and portfolio optimization across the financial sector. As adoption grows, the future of AI in stock market prediction looks promising, offering new opportunities for innovation and helping investors make informed, strategic decisions with greater confidence.

Frequently Asked Questions

How does AI predict stock market trends?

AI uses machine learning, natural language processing, and pattern recognition to analyze historical data and real-time data. It identifies economic indicators and market trends to make predictions about stock trading.

What role do algorithms play in predicting the stock market?

Algorithms, like linear regression or random forest models, process large datasets quickly. They help with predictive analytics by spotting patterns for investment opportunities or technical analysis in portfolio management.

Can AI handle real-time data for stock trading?

AI technology processes real-time data through high-frequency trading systems and algorithmic trading strategies. This allows investors to act on changes instantly while managing risk effectively.

How is sentiment analysis used to predict market movements?

Sentiment analysis evaluates news articles, social media posts, and other text sources using artificial intelligence tools like natural language processing to gauge public opinion that may affect the stock market.

Can diversifying a portfolio benefit from AI predictions?

Absolutely! By analyzing historical data alongside economic indicators using deep learning techniques or neural networks, investors can better diversify their portfolios and identify safer investment opportunities across various markets efficiently.